To date, much of the focus on web3 and blockchain use cases in the fashion/luxury segment has centered on digital asset-tied non-fungible token (“NFT”)-based projects, such as those spearheaded by Dolce & Gabbana, Gucci, Burberry, Louis Vuitton, Rimowa, Prada, adidas, and Givenchy, among others. These efforts – no shortage of which have been limited and/or one-off efforts – proved timely (in 2021 and early 2022) and potentially effective from a public relations perspective. However, NFTs associated with digital assets likely do not represent the most relevant and/or long-term use cases of blockchain in fashion/luxury, and in fact, the market for most art-associated NFTs continues to be underwhelming (but not dead), and save for some exceptions (such as Nike’s .Swoosh venture and the new AeroPax by Aéropostale NFTs), brands are broadening their web3 ventures to move beyond purely digital asset-linked NFTs.

Against this background, stronger use cases for blockchain exist for fashion/luxury market participants – and their legal teams. These include (but are not limited to) the following …

Retailers and manufacturers are turning to blockchain technology to record price, date, location, quality, certification, and other relevant information to better manage their supply chains. “The availability of this information within the blockchain can increase traceability of material supply chains, lower losses from the manufacture/sale of counterfeits and gray market goods, improve visibility and compliance over outsourced contract manufacturing, and potentially enhance an organization’s position as a leader in responsible manufacturing,” according to a supply-centric report from Deloitte.

Enabling a product to be followed through each stage of production, processing, and distribution, including importation and retail sale – with each stage being recorded on immutable distributed ledgers – could ensure that all parties associated with the goods have access to key information that they can trust. For luxury goods makers, being able to establish, record, and share provenance of goods and materials – and thus, the “sustainable” nature of their materials – on a transparent digital ledger could provide significant added value from a marketing and pricing power (and thus, margins) point of view.

– De Beers has been testing its proprietary permissioned blockchain-based system Tracr, which it launched at scale in 2022. Currently, 25% of De Beers’ products are registered on Tracr, which helps companies that are authorized to make bulk purchases of its rough diamonds and retail organizations, alike, to access provenance records. To “reliably trace a diamond’s journey through the supply chain,” Tracr uses blockchain in combination with AI and IoT technologies.

– In 2022, members of the Sustainable Markets Initiative Fashion Industry Taskforce – which was founded by King Charles III and is chaired by YNAP founder Federico Marchetti – announced plans to roll out a Digital ID system to ensure that consumers can access info about how specific garments and accessories are made. Taskforce members include executives at Burberry, Chloé, Stella McCartney, Giorgio Armani, Brunello Cuccinelli, Vestiaire, Zalando, Noon.com, and Moda Operandi.

– Hermès appears to be leaning towards a supply chain-focused approach when it comes to web3 tech, with CEO Axel Dumas telling the WSJ in Sept. 2022 that “blockchain technology allows you to track your supply chain and add data in a faithful way, which is interesting.” (In the same interview Dumas stated, “I’m not sure we’d ever sell an NFT without a physical product.”)

Blockchain technology enables brands to tokenize assets, which ensures that transactions involving those goods – including purchasing, exchanging, and trading – are recorded accordingly. This is meaningful with regards to the burgeoning secondary market and efforts by brands to offer repair/refurbishment services. It is also potentially significant from an authentication/anti-counterfeiting perspective.

Resale and Repair: The ability of consumers to purchase new products that are recorded on a blockchain can be useful considering the growing interest in the resale market for luxury goods. If a product’s ID has been recorded, its authenticity and ownership can be verified (either on the original brand’s website or via a third-party provider’s platform) and transferred to another party, potentially without the need for a resale intermediary and/or with an automatic royalty for the original brand each time the product is transferred. (Nike hinted at the royalty element in its cryptokicks patent.)

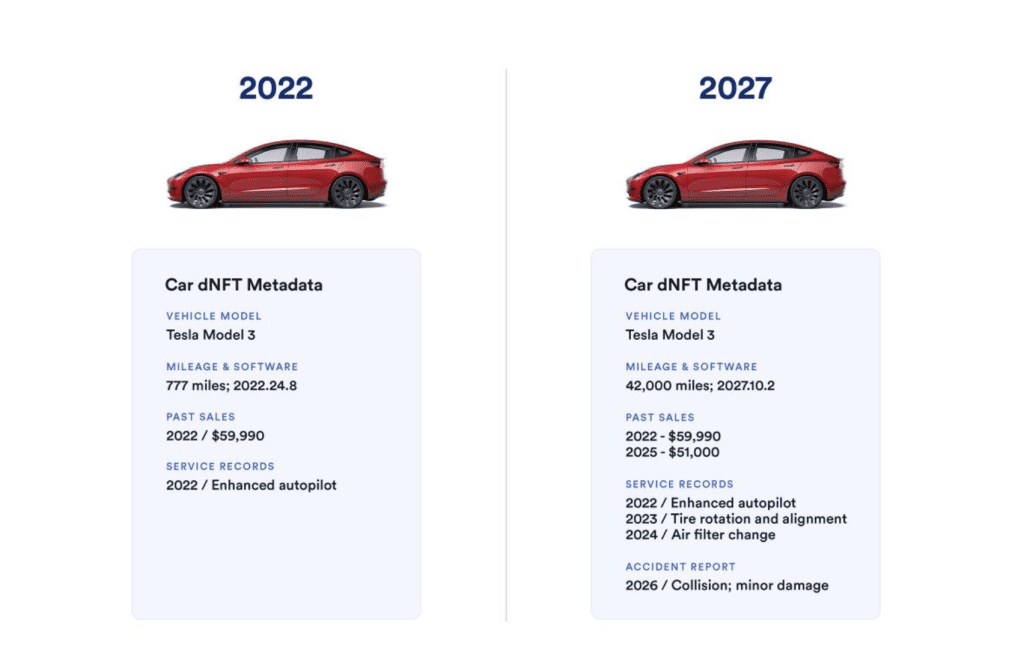

In something of the same vein and given the role that factors like service history, damages, etc. play in determining a car’s value in the secondary market, product tracking could be particularly useful for automakers and resellers, alike. At the same time, similar issues and capabilities are relevant for luxury brands. Luxury watch companies – which somewhat routinely adopt a definition of authenticity that depends on their products being serviced and repaired exclusively by authorized dealers/service providers using branded parts – come to mind. Given that these companies approach the applicability/validity of warranties accordingly, it is easy to see why careful and immutable documentation of service/repairs is critical; such tracing can be achieved, in part, by allowing product owners to upload more information about a product’s status, including recording restorations and product maintenance information, which can be verified by brands.

Companies are also adopting blockchain tech for the purposes of keeping tabs on products after their initial sale, likely due to issues that are readily arising in the resale market. (In addition to companies’ desire to retain some control over how their trademark-bearing goods are presented even after the initial sale takes place, this makes sense in light of the fact that a growing number of companies are looking to introduce repair/service efforts and corresponding warranties as a way to bolster their ESG credentials and in at least some cases, to justify enduring price increases for their products.)

Authentication: On the authentication/anti-counterfeiting front, luxury brands are being encouraged to pair existing one-to-one counterfeit-proof features (such as NFC tags or chips) with NFT technology for improved authentication and tracing. “Smart packaging solutions leverage a range of existing tech, such as NFC, QR codes, and RFID tags, to boost a product’s unit-level traceability,” and can also utilize newer tech, including NFTs and other facets of blockchain, at the same time to “deliver information about the product’s journey” with a heightened level of security, says product authenticity and traceability as a service platform Authena.

– Aura Blockchain Consortium – which was created by LVMH, Prada Group, and Richemont in April 2021 – authenticates products by assigning each a unique digital identity that houses provenance information. By way of multi-nodal, private blockchain, Aura matches a product ID to a client ID, “providing the infrastructure – through a chain of secure, non-reproducible, digital blocks – to permit consumers to access the history of a product and proof of its authenticity.” In doing so, it allows brands to: (1) fight against counterfeiting, and (2) track (and authenticate) luxury goods sold on second-hand platforms.

– LVMH CIO and Aura vice-chairman Frank Le Moal recently addressed the importance of digital passports to promote “long-term products, repair, and care.” Specifically, Le Moal said that, among other benefits, digital passports backed by a blockchain are “a way to provide better repair and care services to customers.”

– Hublot’s e-warranty app, which uses Aura tech, facilitates the verification of a timepiece’s authenticity and the retrieval of its warranty status. In connection with a transaction involving a second-hand watch, the company says that “the Hublot e-warranty app will enable the seller or buyer to check the status of the piece, and will protect against the resale of a stolen watch.”

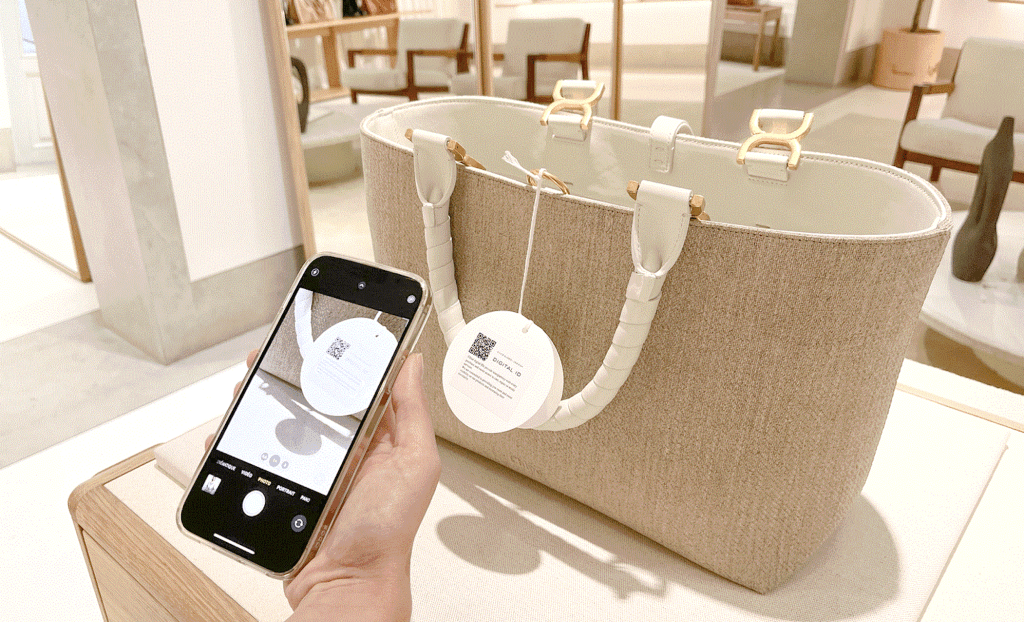

– And in one of the first examples of blockchain-driven resale, Richemont-owned Chloè announced a Digital ID initiative that will enable consumers to not only get a supply chain-centric snapshot of their garments/accessories, but will also provide Digital-ID-connected products with an “Instant Resale capability” through French resale company Vestiaire Collective’s platform.

Token-gating is one example of how brands are using/will use blockchain to engage with consumers. Such a strategy gives digital token holders access to exclusive products, experiences (from store openings to member-only websites), content, etc., and serves as a way for brands to add more value to a physical product. This can provide brands with greater control over who can access their products and content, while token holders – which can include VIP customers, for example – may benefit by getting preferential access based on their level of purchases. Such a token-gated approach could be especially relevant for companies like Hermès and Chanel to use in connection with their most coveted offerings.

– In partnership with Paris-based digital passport provider Arianee, Panerai released a limited-edition NFT-tied watch last year. “The digital asset will unlock exclusive content directly related to the Panerai Experience Edition watches, and will evolve as the experience unfolds to reveal the art piece,” per Panerai, and will give owners “priority access to all future web3 initiatives from Panerai and will be invited to enjoy exclusive services, events and offerings from the brand.”

– LVMH-owned Loro Piana revealed this month that it is rolling out a digital certification service in partnership with Aura, which will see it “leverage QR code technology to verify the authenticity, traceability, and composition of each item,” and to add an element of “storytelling” for each of its offerings’ “unique and complete journey.” The use of tech for the purpose of storytelling is the critical element here, especially for luxury brands like Loro Piana, which are in the business of cultivating meaningful experiences – through heritage-focused storytelling – to market themselves (and drive home their value) and engage with customers.

– Founding Aura member OTB Group is moving forward with an effort to register garments from its Maison Margiela, Marni, and JIL SANDER brands on the Aura blockchain, with Stefano Rosso, CEO of the group’s web3 arm BVX, saying that such blockchain tech is going to “change the way we interact, consume, socialize, and communicate” with consumers. Additionally, OTB says that by pairing items with blockchain, it can “ensure greater transparency and traceability to customers, enable the provision of a new range of services and guarantees product value over time, while also making counterfeiting [of those specific items] impossible.”

Another relevant use case comes in the form of companies’ loyalty programs. As brands continue to focus on building customer loyalty, including via rewards programs, blockchain is being used to enhance such programs and improve operational efficiency. Blockchain-based, multi-channel networks can “eliminate many inefficiencies commonly associated with loyalty program management and add new possibilities for the companies to engage with customers,” per Deloitte – from enabling customers to use a single e-wallet for redeeming all of their loyalty rewards (instead of managing multiple digital accounts) to ensuring that loyalty points can be traced – and targeted at consumers – more precisely.

Additionally, blockchain-based systems can make it so that loyalty-specific transactions are “recorded and accessed by multiple involved parties in near real time,” protected from “double spending, fraud, abuse, and any other type of manipulation of the transactions,” and potentially, frictionless from a consumer point of view.

– Starbucks launched a beta version of Starbucks Odyssey in Dec. 2022, making it “one of the first companies to integrate web3 tech and NFTs with an industry-leading loyalty program at scale.” The Odyssey initiative combines the company’s existing app-based Starbucks Rewards loyalty program – which boasts nearly 30 million active users and drives roughly 50 percent of the company’s order volume – with a Nifty Gateway platform to let consumers to earn and purchase digital “stamps” and unlock access to “exciting new benefits and experiences.”

– Mall retailer Aeropostale recently partnered with MetaversePlus to offer “immersive shopping, socializing, and gaming” in its branded metaverse, AeroWorld. While there are digital asset-linked NFTs at play here – consumers can purchase the 30,000 AeroPax NFTs (with crypto or a credit card), Aero is planning to use the tokens more as a way to offer up members-only perks and promotions, such as “access virtual and IRL experiences, including events and games, and the ability to collect in-game points, which can be redeemed for exclusive AeroPax merch and other VIP perks.”

– American Express piloted a project to integrate blockchain into its rewards program in partnership with blockchain tech company Hyperledger and online grocery retailer Boxed with the aim of rolling out the blockchain-enhanced version of its Membership Rewards program. The aim: To enable merchants and card members to directly and creatively incentivize consumers with more specific offers, while creating real-time visibility and access to those offers.

– And still yet, Hermès revealed during the MetaBirkins trial that this is an area where the brand may be interested in operating, with Nicolas Martin, group general counsel for Hermès, citing the potential use of NFT tech in conjunction with physical products in order to offer consumers token-gated benefits.

THE BOTTOM LINE: The initial rise of digital asset-linked NFTs was likely just the tip of the iceberg in terms of uses for blockchain technologies. In the wake of NFT-centric furor, which was driven in large part by headline-making purchases for Beeple’s The First 5000 Days NFT, which sold for almost $70 million in March 2021 and Yuga Labs’ Bored Ape Yacht Club NFTs, which fetched millions of dollars in their heyday a couple of years ago, etc., and the subsequent “crypto winter,” more practical uses are coming to the fore, and fashion/retail brands are among those that are looking to continue to make strides in this space.