Headlines centered on Burberry this week, with the British brand announcing that Daniel Lee will take the creative helm from Riccardo Tisci starting on Oct. 3, the first big move from CEO Jonathan Akeroyd, who joined in March. The appointment announcement follows days from news that CFO Julie Brown will step down in April and join pharma company GSK as CFO. In a note this week, Bernstein analyst Luca Solca said that Lee “seems an appropriate choice for Burberry, as he has demonstrated the ability to create a highly successful new chapter for Bottega Veneta.” In particular, he is expected to “open [an] opportunity” for the brand in the handbags & shoes categories, where Burberry “has struggled to make its mark and create high profile iconic products.”

Balenciaga revealed this week that it will enter the resale market via a partnership with Reflaunt, the Lisbon-headquartered reseller that counts Balenciaga CEO Cédric Charbit as an investor. (This seems to mirror a move by fellow Kering-owned brand Alexander McQueen, which partnered with Vestiaire last year. As of March 2021, Kering maintained a 5% stake in Vestiaire, leading a $216 million funding round for the reseller alongside American investment firm Tiger Global Management.)

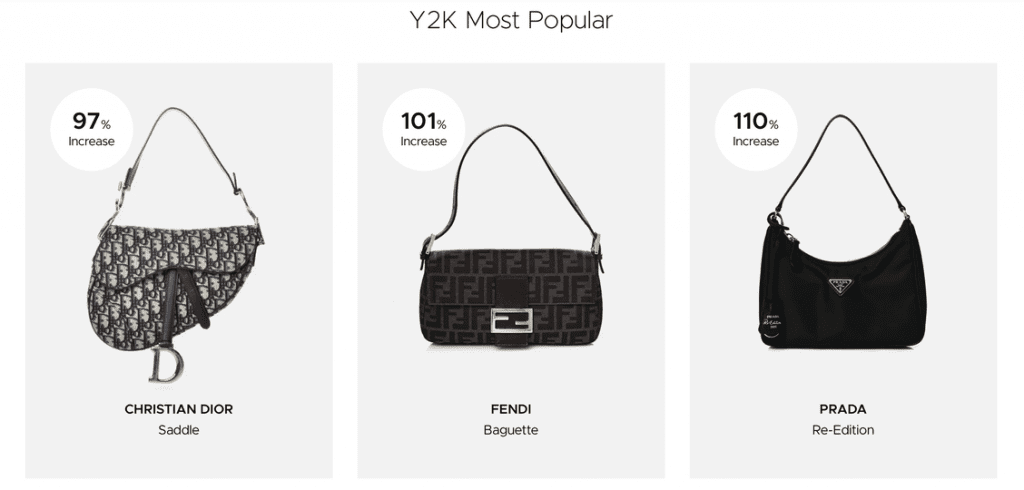

In other resale news, FashionPhile released its “Ultra-Luxury Resale Report” this week, highlighting the power of brand collabs; the popularity of Y2K inspired styles among Gen Z and Millennial shoppers; “considerable” rises in demand for Chanel and Hermès bags; and the reseller’s efforts to “take stock of the creation of assets like NFTs, as well as customizable filters and avatars.”

In terms of litigation, both Hermès and Mason Rothschild filed notices of summary judgment this week, with Hermès seeking judgment in its favor on its claims for TM infringement, unfair competition, dilution, and cybersquatting on Wednesday, and MetaBirkins creator Rothschild angling for an order “dismissing all of Plaintiffs’ claims, and for such other and further relief as the Court deems just and proper.” (You can find those filings here and here.)

In recent deal-making news: Tod’s founder Diego Della Valle will buy out remaining shares in Tod’s SpA by way of a medium-term loan provided by BNP Paribas SA’s BNL unit, Credit Agricole SA and Deutsche Bank AG. According to a regulatory filing from Della Valle’s DeVa Finance Srl, the Della Valle family will use its 49% stake in Tod’s as collateral for the 420 million-euro loan to fund the buy out.

– Essity completed its acquisition of Knix, the digitally-native intimates brand, for $320 million. The Swedish hygiene and health co. has an 80% stake in Knix, while Knix CEO and founder Joanna Griffiths has the other 20%.

– Australian fashion retailer Universal Store has acquired Byron Bay brand Thrills for $50 million in furtherance of what Universal Store CEO Alice Barbery says is “a strategic move” for the retailer.

– Gruppo Florence continues on its acquisition spree, acquiring “shoe specialists” LorenzaCalzaturificio and Novarese, as well as Officina Ciemmeci. (More to come on this soon.)