The company behind the Bored Ape Yacht Club non-fungible tokens (“NFTs”), Hollywood agent Guy Oseary, and a number of big-name celebrities and brands – from adidas and Universal to Justin Bieber, Madonna, Gwyneth Paltrow, and Serena Williams – are among a long list of defendants that are allegedly on the hook for perpetuating a scheme to promote Bored Ape NFTs, while simultaneously running afoul of federal and state laws. In the lawsuit that they filed in a California federal court on December 8, Plaintiffs Adonis Real and Adam Titcher claim that the defendants engaged in an effort to dupe consumers by way of “manufactured celebrity endorsements and misleading promotions” that helped to “artificially increase the interest in and the price of the Bored Ape NFTs,” causing “investors” to purchase the NFTs at “drastically inflated prices.”

According to the newly filed lawsuit, the defendants’ efforts to inflate the interest in – and prices – of Bored Ape NFTs came by way of a “vast scheme between blockchain startup company Yuga Labs, highly-connected Hollywood agent (Guy Oseary), front operation (MoonPay),” and more than a dozen famous figures, “who all united for the purpose of promoting and selling a suite of digital assets.” Specifically, Real and Titcher assert that Yuga executives and Oseary “together devised a plan to leverage their vast network of A-list musicians, athletes, and celebrity clients and associates to misleadingly promote and sell Yuga Financial Products” in exchange for being “highly compensated” – albeit “without disclosing such [compensation].”

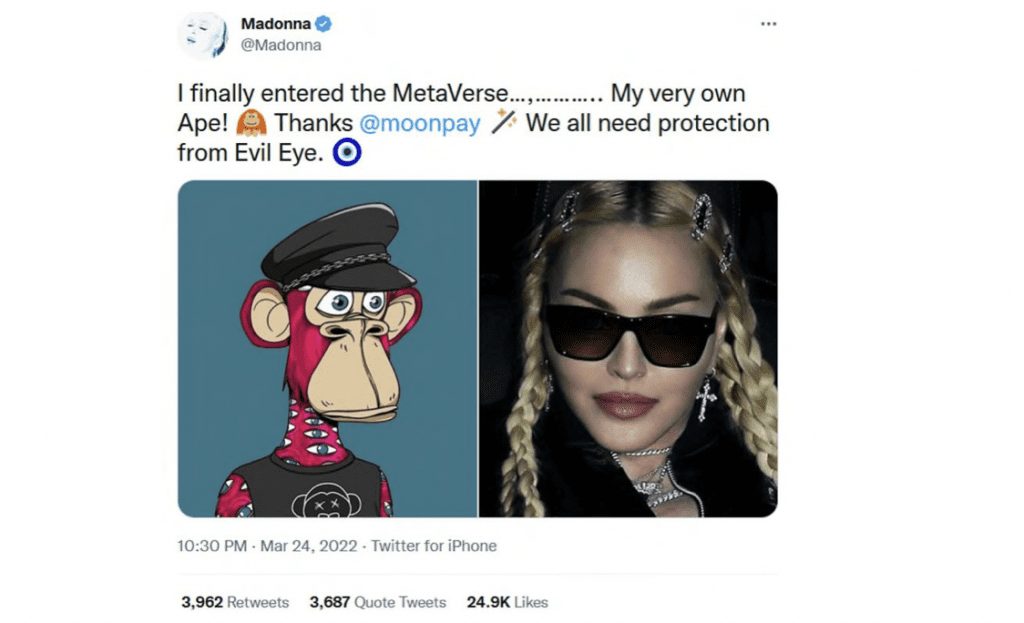

The allegedly undisclosed celebrity promotions of the BAYC NFTs and MoonPay, the latter of which “purports to be a white-glove service designed to help the super-rich and celebrities buy NFTs,” range from on-air shoutouts from Jimmy Fallon to social media posts from the likes of Paltrow, Bieber, Madonna, among others.

Specifically, the plaintiffs claim that on a November 21 episode of the Tonight Show, Fallon “promoted MoonPay and the BAYC NFT collection” by saying that he “bought an ape” using MoonPay’s services when, in reality, “MoonPay and/or Oseary … recruited and paid Fallon to promote both MoonPay and the BAYC collection during the segment on the Tonight Show.” Fallon “did not disclose that he had a financial interest in MoonPay,” which he is an early investor in, “or that he was likewise financially interested, directly or indirectly, in the increased sale or popularity of the Yuga securities,” according to the complaint. (Oseary’s venture capital firm, Sound Ventures, was one of the early investors in MoonPay, along with, Justin Bieber, Paris Hilton, Jimmy Fallon, Gwyneth Paltrow, [and] Serena Williams,” among other defendants, Real and Titcher allege.)

More than that, the plaintiffs maintain in their lawsuit that Fallon subsequently promoted his Bored Ape NFT and MoonPay on Twitter, but again, “failed to disclose that [his] promotion” was “solely due to his financial interest.”

Real and Titcher similarly point to Paris Hilton’s January 2022 appearance on Fallon’s show, during which she promoted both the BAYC NFTs and MoonPay, and followed up that appearance with social media promos for the two ventures. They claim that “Hilton and MoonPay purposefully did not disclose Hilton’s direct financial interest in MoonPay and relatedly, the increased sale of Yuga securities through MoonPay.” And again, they claim that “there was no disclosure from any of the Tonight Show‘s production companies …. regarding Hilton’s and/or Fallon’s financial interests in MoonPay or compensation for promoting the BAYC NFTs.”

“Other members of Oseary’s network follow a similar pattern of promoting the BAYC collection of NFTs in connection with MoonPay,” according to the plaintiffs, who state that each of the famous endorsers “received Yuga Financial Products and/or other forms of consideration as part or all of their compensation for promoting the Yuga securities or the Yuga brand generally” but failed to disclose that compensation as required by the Federal Trade Commission (“FTC”) (which we previously dove into here), and potentially, the Securities and Exchange Commission (“SEC”), as well.

(The FTC requires that endorsers disclose “material connections” with their sponsoring advertisers by way of clear and conspicuous language; the FTC has previously stated that vaguely thanking the advertising party is insufficient. Meanwhile, the SEC has stated that individuals who promote “a virtual token or coin that is a security must disclose the nature, scope, and amount of compensation received in exchange for the promotion,” which means that disclosures, such as #ad, on their own, are not sufficient when the product/asset being promoted is a security.)

While the defendants’ efforts to boost demand for and the prices of the BAYC NFTs was successful, the plaintiffs argue that “the meteoric rise of the BAYC NFTs did not last long, and the floor price of the collection began to deflate immediately after the failed launch of the BAYC metaverse and botched sale of virtual land on the Otherside [platform] on April 30, 2022.” With the foregoing in mind, the plaintiffs set out a number of claims, including violations of section 10(b) of the Exchange Act, which prohibits fraud in the purchase or sale of securities; and sections 5 and 12(a)(1) of the Securities Act, which prohibit the unregistered offering and sale of securities. They similarly accuse the defendants of running afoul of California Unfair Competition Law and California Consumers Legal Remedies Act, and of engaging in aiding and abetting, and civil conspiracy.

In addition to seeking certification of their proposed class action case, the plaintiffs request “appropriate injunctive relief” and monetary damages.

It is unclear whether the lawsuit allegations will garner attention from the FTC in light of the alleged breaches of the FTC Act by the defendants in connection with their undisclosed promotion of Bored Ape NFTs. As for the SEC, the lawsuit comes on the heels of reports this fall that the agency was probing Miami-based Yuga Labs to determine whether its offerings amount to unregulated securities. “The SEC is examining whether certain NFTs from [Yuga Labs] are more akin to stocks and should [be subject to] the same disclosure rules,” Bloomberg first reported in October, citing a person familiar with the matter. The SEC was also said to looking at Yuga’s release of ApeCoin governance tokens, which were distributed this spring to certain Bored Ape NFT holders.

The case is Adonis Real, et al., v. Yuga Labs, Inc., et al., 2:22-cv-08909 (C.D. Cal.).