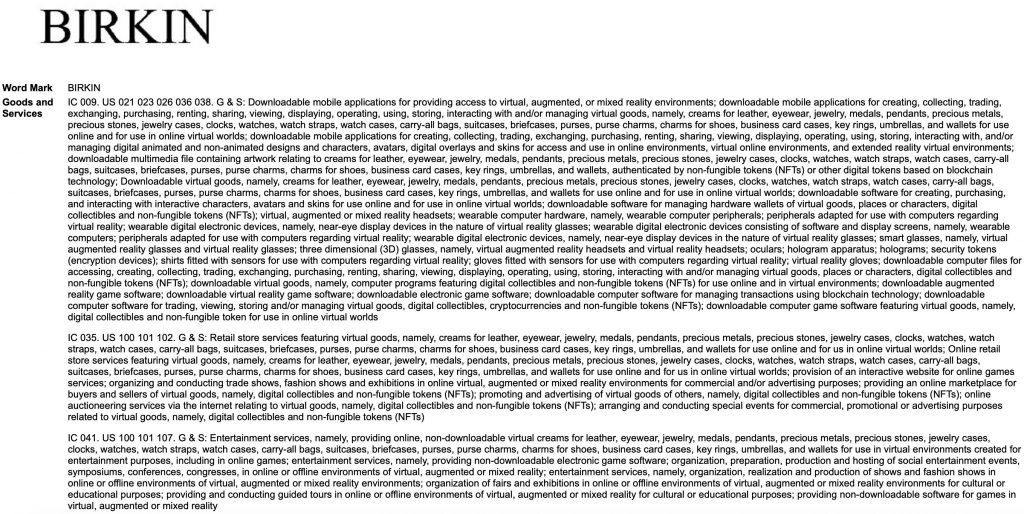

Hermès made headlines this week when in the wake of filing a trio of intent-to-use trademark applications for registration, seeking to register its name, along with the Birkin and Kelly word marks, across a number of quintessential metaverse classes of goods/services – namely, Classes 9, 35, and 41 for the two famed handbag style names and a longer list (9, 35, 36, 41, and 42) for its name. (These are among the latest on our Enterprise-exclusive list of NFT and metaverse-related trademark filings, which you can find here.) The filings with the USPTO come amid the trademark battle that the French luxury company is waging against artist Mason Rothschild over his sale of a collection of 100 MetaBirkins NFTs that include images depicting furry renderings of its famous Birkin bag.

Hermès has claimed in connection with that suit that while it “has not yet minted and sold its own NFTs” (or taken part in broader metaverse ventures to date, as a growing number of its peers have), it, nonetheless, “has the right to do so at the time and manner of its choosing.” While it is difficult to imagine the likes of Hermès, Chanel and co. rolling out metaverse ventures (such as partnering with metaverse platform Roblox like Gucci and Nike have done) any time soon, it would be far less of a stretch to see them making use of NFTs to log data associated with the manufacturing and sale (and potentially, resale and repair) of their pricey handbag offerings.

A contract battle may be brewing between Kanye West and his biggest fashion/retail partners, adidas and Gap. In a string of social media posts over the past few months, the rapper-slash-design figure has accused the companies of copying his designs (a Gap t-shirt prompted ire this week and a Yeezy-looking slide from adidas’ main line come before that) – and very recently, West called out the companies for failing to make good on allegedly promised physical retail ventures. “I signed with both Gap and adidas because it contractually stated they would build permanent stores which neither company has done even though I saved both those companies,” West said in an Instagram post on Wednesday.

In a litigation development that caught my eye this week: Counsels for Miramax and Quentin Tarantino alerted the U.S. District Court for the Central District of California that they have not settled the case that Miramax filed suit against Tarantino in Nov. 2021, seeking to enjoin the Pulp Fiction director from auctioning off “exclusive” memorabilia associated with the film in the form of “secret” NFTs. Miramax has set out claims of copyright infringement, trademark infringement, and unfair competition. According to their very-brief Sept. 1 status report, following “informal settlement discussions” on Aug. 30, Miramax and Tarantino’s “representatives and counsel participated in a full-day, in-person mediation session,” but … “the case did not settle.”

And this week’s deal-making news comes on the skincare/beauty front: South Korea-based Amorepacific Corp will buy Tata Harper, as part of “a strategic push to tap into the growing North American market.” While the terms of the deal were not disclosed, Reuters reports that “Amorepacific said in a filing that it would invest 168 billion won ($123.86 million) in its U.S. business to buy Tata Harper.” The deal comes amid reports for other consolidations in the cosmetics space. On the heels of Estée Lauder Cos. reportedly looking to snap up Tom Ford, the New York-based giant is said to be close to reaching a deal to acquire a license for Balmain beauty.