Deep Dives

As I highlighted in a recent newsletter, Rolex’s launch of a Certified Pre-Owned program is providing some real insight into what brand-owned secondary market endeavors look like in the luxury segment. While resale is by no means a new segment, the entrance of some of the biggest names in luxury (namely, hard luxury) is presenting a first-hand look at how such endeavors will work. Early this month, the Swiss watchmaker confirmed that on the heels of the resale endeavor rolling out in Dec. at Bucherer locations in Europe and the UK, select Tourneau Bucherer and Watches of Switzerland locations in the in the U.S. had begun offering up pre-owned Rolex models that have been approved and authenticated by the brand, itself. In addition to ensuring authenticity, Rolex is implementing a new two-year international warranty on the pre-owned watches by way of the program.

ICYMI: The most immediate takeaway from the Certified Pre-Owned program is the element of control. By participating in the resale market, Rolex can exercise a strong hand in dictating the buying experience in third-party retailers’ stores, the condition of the watches being traded, some of the conditions of the sale, etc. For example, Rolex has dictated how the pre-owned watches should be displayed (i.e., in a specific/separate section of participating retailers’ stores), and what the packaging looks like (pre-owned watches will come with distinct Certified Pre-Owned packaging), among other things.

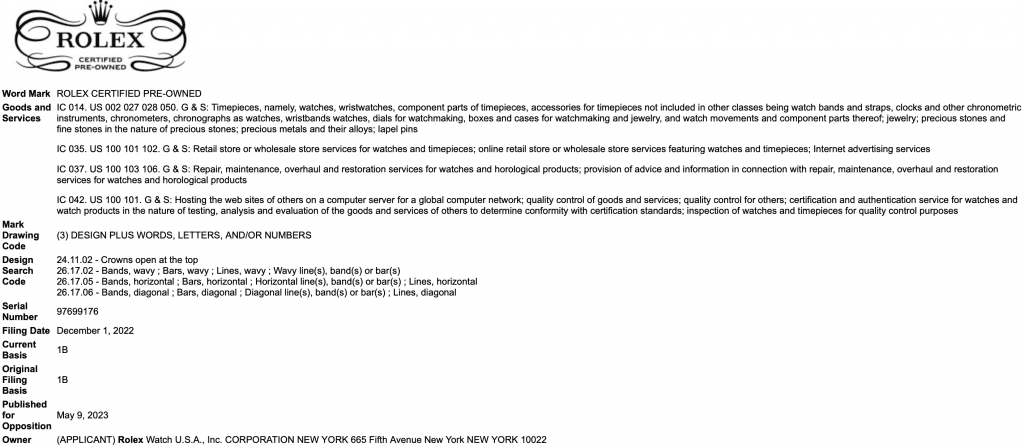

Here are a few of the marks that Rolex is using (and filing applications for registration for) in connection with the Certified Pre-Owned venture …

From what we can garner from Rolex, the first consumer-facing step for launching brand-owned endeavors comes in the form of an initial market test. Rolex preliminarily launched its Pre-Owned program in a limited capacity with an existing partner, Bucherer, in select locations in Europe and the UK in December. The second step is scale, which Rolex appears to be in the very early stages of, having adopted a broader reach by incorporating U.S. retailers in May, with plans to expand further. (There is also the test-and-launch in-house approach, which Gucci did when it partnered with a true third-party, The RealReal, for a limited initiative back in 2020 before ultimately launching limited resale by way of its own Vault venture. The Italian fashion brand does not appear to have scaled its efforts here, with stock still limited to a small supply of “collector’s items with unique customizations and rare Reconditioned pieces by the House.” I have been keeping my eye on this effort and will report on any changes in its approach/scale.)

The Bigger Picture here is a rising embrace by companies like Rolex – and Audemars Piguet, which is set to launch certified pre-owned program by end of 2023 – of the resale channel for their offerings. This indicates that brands want in on one of the biggest results of their strategy of consistently limiting the supply of their goods: a robust secondary market. This is also an apparent acknowledgment by brands of the fact that resale and retail can co-exist for luxury goods. (This is distinct from the view of those that see resale as a threat/a channel that will cannibalize primary sales.) Revenue is, of course, also a factor worth noting, with Audemars CEO François-Henry Bennahmias stating early this year that the company anticipates that its pre-owned business will be bigger than retail sales of new models.

At the same time, in light of the continued existence of sophisticated counterfeit goods, brands have a distinct advantage when it comes to the secondary market. “Labels are learning they have an advantage over multi-brand platforms because they hold the documents that allow them to easily authenticate [pre-owned] pieces,” according to McKinsey senior partner Achim Berg. He notes that brands can “certify the origin and authenticity of products [in order to] fight counterfeiting, which is one of the main risks associated with [the resale] business model.”

Even beyond the aforementioned elements, companies should consider the role of ESG factors (when it comes to the resale segment) from: (1) a consumer POV; (2) a pricing standpoint; and (3) a brand valuation perspective.

Consumer POV: It is no secret now that consumers, particularly Gen Z, place weight on brands’ efforts on the ESG front, including in the resale realm. This means that brands that actively participate in the secondary market stand to gain goodwill among this particularly-prized consumer demographic. Not only are younger consumers (i.e., Gen Y, Z, and Alpha) set to become the biggest group of buyers of luxury goods by 2030, they are starting to spend in luxury goods at a younger age. Gen Z shoppers are making their first luxury purchases 3 to 5 years before their millennial counterparts, according to a Bain & Co. and Altagamma study. The availability of brand-owned resale may lure these consumers in now and/or pave the way for them to become loyal full-priced clients in the future.

Pricing POV: Brands can use resale to their advantage when it comes to price – something that seems particularly relevant amid enduring efforts (by brands ranging from Coach to Chanel) to raise price tags. While many brands have robust pricing power and thus, the ability to hike prices again and again, some, nonetheless, appear to see value in implementing things like repairs, extended warranties, etc. to boost the value in the eyes of consumers and thus, substantiate the consistent price boosts. Resale can be helpful here, as consumers have shown that they will put a higher value on – and pay more for – goods if there is a robust resale market for those products, and this sentiment is likely heightened even further if brands, themselves, are involved in the resale market. “For discerning consumers, brand involvement is an attractive prospect,” per McKinsey.

Brand Valuation POV: Brands’ ESG credentials – which can include circularity efforts, such as resale initiatives – are also starting to impact their valuations. Interestingly, Brand Finance introduced a new sustainability metric to its brand valuation methodology, stating that it “assesses the role that specific brand attributes play in driving overall brand value” and that “one such attribute [that is] growing rapidly in its significance is sustainability.” The bottom line here, per Brand Finance? “Even for individual businesses, there could be billions of dollars of financial value to be gained from enhanced action [on the ESG front] and associated communication.” (The London-based consultancy notes that its sustainability metric table “is not an assessment of a company’s overall sustainability performance,” but rather is an indicator of brands’ reputation for sustainability and “how much brand value it has tied up in sustainability perceptions.”)

Ultimately, while bringing resale efforts in-house (as opposed to partnering with established resale entities) brings benefits, it is not without challenges. Berg states that should brands opt to attempt resale on their own, they “need to figure out reverse logistics, train staff to authenticate, and figure out how to scale their resale model sustainably.” At the same time, amassing stock could prove an issue; with The RealReal, for one, explicitly stating in its May 2019 S-1 filing with the Securities and Exchange Commission that “exclusive, authenticated pre-owned luxury supply drives demand,” and noting that “fragmented supply” as an overarching issue inherent in “existing luxury resale models.”

It is worth noting, however, that the number of Rolex watches and Hermès Birkin and Kelly bags, for instance, that are out in the market is higher than one might think. (Bernstein analyst Luca Solca previously estimated that Hermès makes/sells 70,000 Birkins every year, with a million-or-so already in circulation.) This gives brands a potentially sizable pool to access/work with. As for where such stock will come from, in Rolex’s case, it appears to be coming by way of customers of its authorized distributors, making it so that the Pre-Owned program actually opens up a direct line between Rolex and customers who want to offload watches. This potentially serves to cut out third-party resale platforms that these individuals may have had to rely on before Rolex launched its Pre-Owned effort.

Despite such issues, the good news is that after years of discussions about the merits (and drawbacks) of luxury resale and brands’ participation in it, those in the luxury space are increasingly about to follow in the footsteps of leaders like Rolex, as well as other fashion-focused players like Gucci and other Kering-owned brands, Chloè (and its parent Richemont, which was an early-mover and acquired Watchfinder back in 2018), Valentino, etc. – that are actively participating in the secondary market. These big names provide examples of how to approach this market segment that does not seem to be going away or losing steam anytime soon, and of what is/is not working.