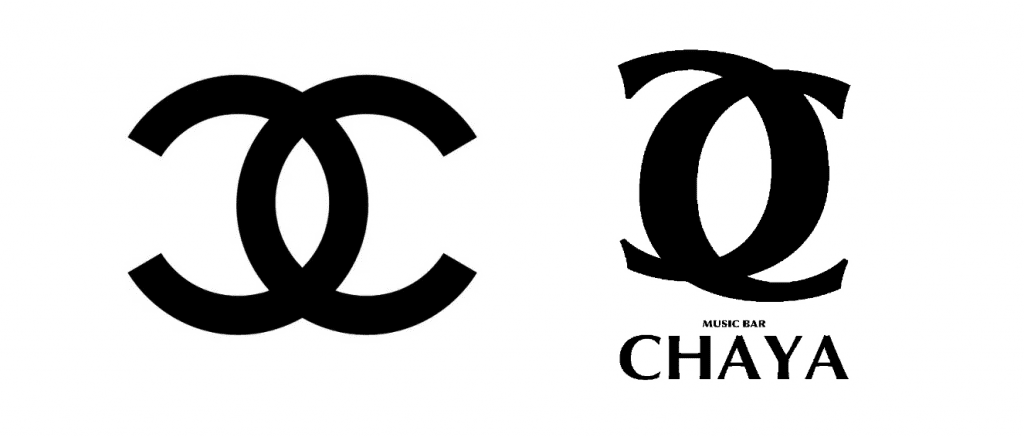

Chanel was recently handed a loss by the Japan Trademark Office (“JPO”) in its quest to shut down the registration of a trademark that consists of two interlocking “C”s on the basis that it is likely to confuse consumers. In the opposition that it waged on April 30, Chanel asserted that the trademark that Japanese entity HIC Co., Ltd. filed for use in connection with restaurant services should not be registered in light of the “remarkable degree of popularity [of] and the reputation” associated with Chanel’s own double “C” logo, and the resulting likelihood that consumers might be confused into thinking that the two companies are related or that Chanel has authorized HIC Co.’s services. Beyond that, Chanel argued that given the similarity between the two companies’ marks, HIC Co., Ltd. must have adopted – and sought to register – its logo in order to unfairly trade on the reputation and goodwill associated with Chanel’s well-known trademark.

In a decision dated September 30, as first reported by Osaka-based trademark attorney Masaki Mikami, the JPO Opposition Board agreed with Chanel that its interlocking “C” logo has acquired “a high degree of reputation among relevant consumers,” noting that the brand generates revenues that are greater than 50 billion JP-Yen in Japan each year ($340 million), and that it has spent 5 billion JP-Yen ($34 million) on advertising in Japan each year since 2014.

Even against that background, the Opposition Board sided with HIC Co., Ltd., determining that the two marks simply are not similar enough to give rise to a likelihood of confusion. Specifically, the Opposotion Board found that while the two trademarks “share a similarity in that they are both figures with two ‘C’-shaped curves placed back-to-back on the left and right sides so that parts of the curves overlap,” the parallels end there given that two the interlocking “C”s are presented differently by Chanel and HIC Co., Ltd. With that in mind, the JPO dismissed Chanel’s opposition and will register HIC Co.’s mark.

(The decision comes over a year after the Fourth Board of Appeal of European Union Intellectual Property Office dismissed an opposition that Chanel lodged over an interlocking logo that Chinese tech titan Huawei’s sought to register for use on computer hardware and software programs.)

The Japanese Luxury Market

While Chanel – and other similarly situated brands – are no strangers to globe-spanning opposition efforts, at least part of the bigger picture here is the robustness of luxury goods sales in Japan, and luxury brands’ increasing pivots to focus on the Asia-Pacific markets, primarily China, Japan, and South Korea, as key drivers of growth going forward.

China is, of course, the main focus, for brands, with luxury goods sales there doubling between 2019 and 2021 to more than $74 billion, per Bain & Company data, keeping the country on track to become the world’s largest luxury market by 2025. Not to be overlooked, though, Japan is a vital market, with luxury goods sales amounting to $22 billion in 2018, and according to McKinsey analysts, such sales are expected to rise by approximately 4 percent through 2025, with such growth coming from domestic shoppers, specifically younger and wealthier demographics.

Reflecting on luxury goods’ 2021 results, Japan was a notable market, with LVMH, for instance, reporting that for the full year, sales in Japan represented 7 percent (4.38 billion euros) of its total annual revenue (64.2 billion euros). In terms of individual business groups, the Japanese market drove a cool 11 percent of jewelry sales and 9 percent of the group’s prized Fashion & Leather Goods group, which generated revenues totaling 30.8 billion euros for FY 2021. For Kering, the sales in Japan amounted to 6 percent of its total 17.6 billion euros in FY 2021 revenue, and 6 percent of Gucci’s sales for the year and 10 percent of Bottega Veneta sales. (Gucci generated 9.7 billion euros in global sales in 2021 and Bottega’s sales topped 1.5 billion euros.)

And finally, Hermès reported that for FY 2021, the sales in Japan amounted to 977 million euros of its total 8.8 billion euros. (Chanel does not break out sales beyond the Asia-Pacific market.)

More recently, LVMH reported that for the 3-month period ending on September 30, it saw “sharp” sales increases in Europe, the United States, and Japan, thanks to “solid demand of local customers,” as well as “the recovery in international travel.” Hermès similarly cited notable Q3 sales in Japan, pointing to a 21 percent increase compared to Q3 2021 and “the regularity and solidity of its growth, thanks to the loyalty of local clients.” Still yet, Kering’s sales in Japan were up by 31 percent year-over-year, which the group characterized as “particularly outstanding,” especially compared to growth in the North America market, which was up by just 1 percent.

Other counties in the Asia-Pacific region are expected to play a bigger role when it comes to luxury spending, but analysts anticipate that China and Japan will continue to be the biggest markets (and brands will continue to be heavily reliance on them for growth), making it integral for luxury companies to amass and enforce their brand-centric assets there.