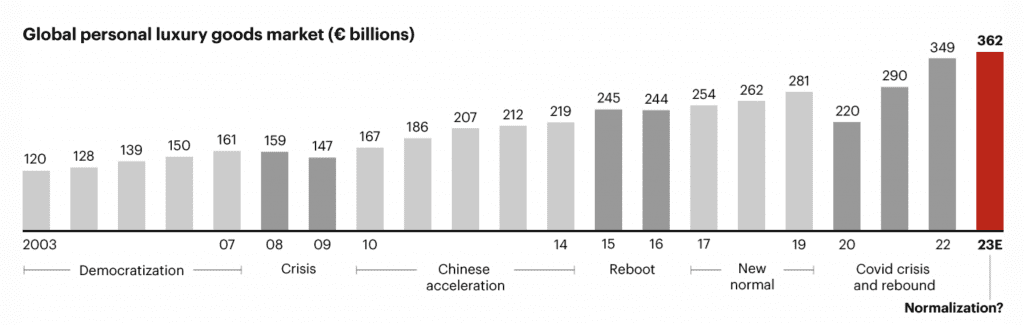

The global luxury market is projected to reach €1.5 trillion in 2023, an 8-10% increase over 2022, according to a report released this week by Bain & Co. in conjunction with Italian luxury goods manufacturers’ industry association, Altagamma. The value of the personal luxury goods market, alone – which is the “key segment,” per Bain – is set to hit a record €362B this year, up 4% from 2022 at the current exchange rate (and 8% at constant exchange rate).

Asia is setting the pace here thanks to domestic demand & a renewed influx of Chinese tourists in the region. “Europe is on track to post a robust gain for the year,” whereas the Americas have seen a deceleration throughout the year, posting an 8% drop from 2022, as “widespread uncertainty continues to impact aspirational customers’ spending.” While “widespread uncertainty continues to impact aspirational customers’ spending,” top customers remain confident & willing to spend – albeit not on their home turf. Bain found that these consumers have maintained their spending abroad, as the U.S. dollar remains strong against the euro & price differentials favor oversea purchases.

2023 in a nutshell: “The luxury market is generating positive growth for 65-70 percent of brands in 2023, compared to 95 percent in 2022.”

Looking ahead: As we previously reported, if 2023 was bad, luxury execs. expect 2024 to be worse. In a nod to this sentiment, Bain’s research “suggests a softening personal luxury goods performance in 2024, achieving low-to-mid single digit growth over 2023, based on current scenarios.” For 2024, Bain’s “probable scenario” forecasts a rise of between 1-4 percent at constant exchange rates, while a more optimistic range goes up to 7 percent, with a return of tourist flows “likely outpacing demand from locals.”

Bain’s guidance for brands? “Players have the opportunity, but also the responsibility, to reinforce their meaning, while leveraging strategic M&A to redefine the boundaries of the industry.” The emphasis on redefining – or maybe better yet, reinforcing – the bounds of luxury is interesting, as it seems to fall neatly in line with the push by big groups and brands to double-down on experiences as a way to: (1) further cater to their most-engaged (read: high-spending) clientele, and (2) I suspect, beat (or in some cases, get ahead of) the fatigue among other consumers who feel that they already have enough stuff, and thus, are prioritizing experiences over shopping for even more goods.

Brands’ expansion into travel and leisure/hospitality is a crystal-clear indicator of this. Case in point: LVMH-owned Belmond announced its plans to acquire Castello di Urio, a 16th-century estate on Lake Como, on Friday, adding to the luxury travel pioneer’s growing portfolio. (LVMH completed its acquisition of Belmond – which owns more than 45 luxury hotel, restaurant, train and river cruise properties – in 2019 in a deal with a $3.2 billion enterprise value.)

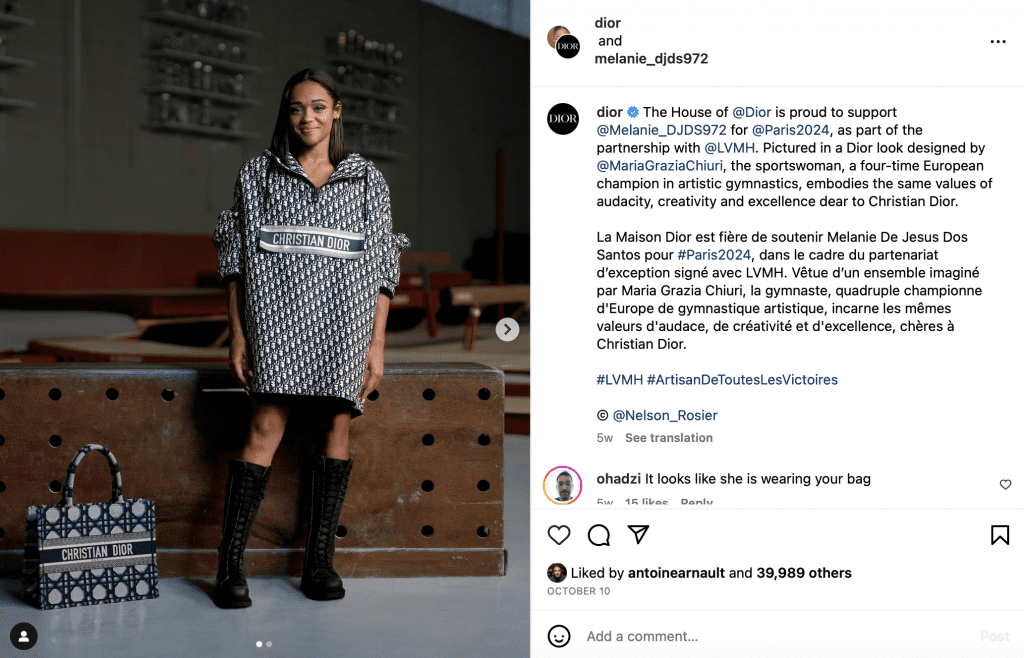

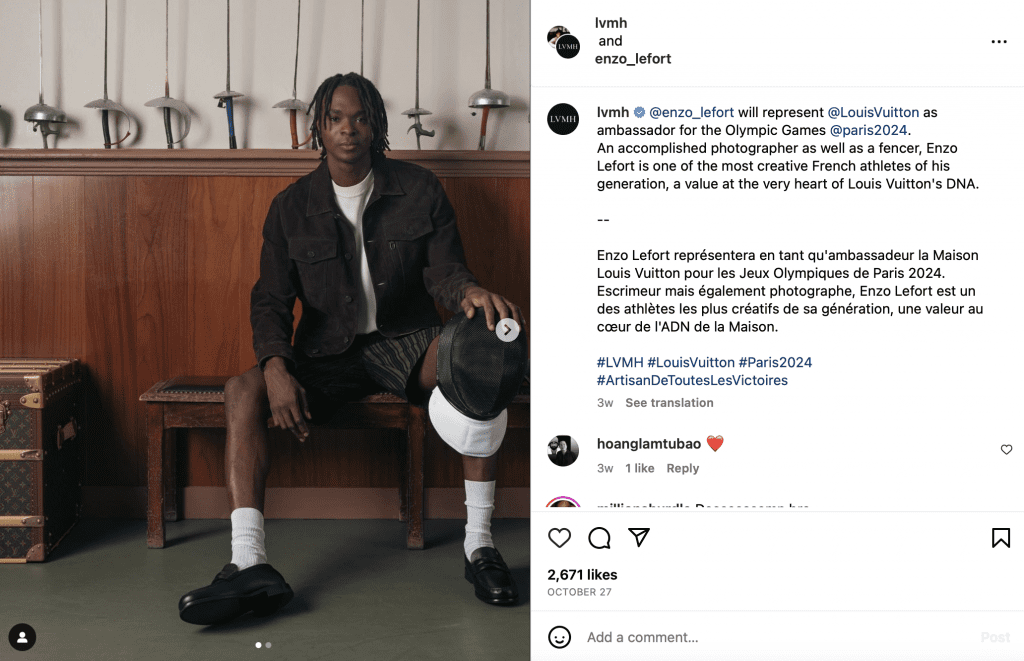

There is no need to look beyond LVMH for additional examples, including on the sports front, which is making notable gains when it comes to luxury. For one thing, the world’s largest luxury group is acting as a “premium partner” for the Paris 2024 Olympics (a title that reportedly came with a $166M price tag). New announcements are coming regularly in this realm – from LVMH-owned Berluti announcing that it will design the Olympics opening ceremony uniforms for French teams to Dior nabbing French gymnast Mélanie de Jesus dos Santos and Louis Vuitton naming French fencer Enzo Lefort to act as brand ambassadors for the Games. You can inevitably expect many more announcements to come (from LVMH and other groups/brands) ahead of the summer 2024 kickoff.

– Tangle, Inc. v. Aritzia, Inc: Tangle alerted a NY fed. court that it will not amend its complaint in the case it has been waging against Aritzia over the retailer’s allegedly infringing window displays.

– Vans v. Walmart: On the heels of telling the court that they have reached a settlement in their sneaker-centric trademark clash, Vans & Walmart have lodged a consent permanent injunction with the court, barring Walmart from “using Vans’ Side Stripe Mark, Old Skool Trade Dress, Checkerboard Trade Dress … or any of Vans’ registered TMs” on footwear products. (The injunction is right here.)

– Whaleco Inc. v. dltemuapp.com, et al: Temu has filed a second TM infringement cybersquatting lawsuit this month against parties allegedly offering up copycat apps and coupon codes. (More about the initial suit here.)

– Herbal Brands Inc v Photoplaza Inc: A number of online resellers are seeking SCOTUS intervention after the 9th Cir. held that the sale of a product via an interactive website provides sufficient “minimum contacts” to support jurisdiction over a non-resident D in a state where the D causes the product to be delivered.

– Adrian Cheng has taken a majority stake in 1017 Alyx 9SM, the label launched in 2015 by current Givenchy creative director Matthew Williams.

– UK-based fashion brand Urbanic has raised $150M in a Series C round.

– AI-powered skincare platform Haut.AI has raised €2M in Seed funding.

– IP management platform Tradespace has raised $4.2M in Seed funding.

– 3D generative AI platform Atlas has launched from stealth after raising $6M in Seed funding.

– Jimini AI, which aims to empower law firms through AI, has raised €1.9M in Seed funding.

– Textile recycling logistics platformSuperCircle has raised $7M in a Pre-Series A round.

– End-to-end retail distribution solutions provider etaily has raised $17.8M in Series A funding.

– Blue Yonder, a leading supply chain solutions provider, has finalized its acquisition of Doddle.