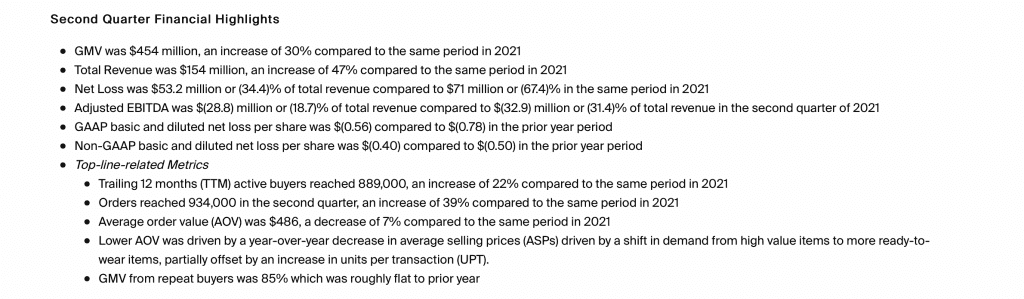

The RealReal said that it “delivered solid results in the second quarter of 2022,” reporting that its revenue for Q2 grew by 47 percent year-over-year to $154 million, while its gross merchandise value (“GMV”) – the company’s most heavily-touted metric – rose by 30 percent to reach $454 million. Top-line GMV growth (i.e., growth in the value of the merchandise sold) was “slightly lower than expected” for the three-month period ending on June 30, but the San Francisco-based luxury resale giant says that it, nonetheless, “met [its] revenue projections and exceeded [its] guidance on adjusted EBITDA.” And still yet, the company’s net loss was down for the quarter from $71 million (67.4 percent of total revenue) in Q2 2021 to $53.2 million (or 34.4 percent of total revenue) for the most recent period.

“Our top-line growth experienced some pressure during the second quarter due to a sales labor-related supply shortfall,” Rati Sahi Levesque, co-Interim CEO and COO stated in a release on Tuesday, noting in a call with analysts on Tuesday that early in Q2 the company saw an increase in attrition, which they are calling “The Great Resignation Part Two.” The company “already needed to grow [its sales] team,” per Levesque, and so, “the combination of not being able to grow that team fast enough and the attrition volume was tough for us.”

GMV for the quarter was not merely dragged down by a lack of sales support, though, as management for The RealReal stated that the value of goods sold fell due to a overarching shift in consumer demand in the wake of the pandemic. “While high value continues to perform, the second quarter mix more closely mirrored pre-COVID product mix, as consumers go back to the office, travel more and attend events,” thereby, driving up sales of ready-to-wear, for instance, Levesque stated. As a result of the higher proportion of GMV coming from apparel, as well as categories like shoes, the company saw a reduction in average selling price and average order value for the quarter.

This comes in contrast to the trend of sales during the midst of the pandemic when The RealReal’s results revealed that consumers appeared to be buying less – but more expensive offerings. During Q1 of 2021, for instance, while the average units per transaction dropped by 4 percent in Q1, the average order value grew by 6 percent to $474. For the same quarter, the company pointed to a 10 percent year-over-year increase in average selling price, which it said was due to “strength in the Fine Jewelry category and strong demand in high-value handbags,” as well as watches.

The trend was similarly reflected in the annual “Resale Report” that The RealReal released in August 2021, in which the company stated that collectors were not only buying more high-value items, such as watches, than usual (TRR revealed that consumers purchased 1.4x more watches than they sold during the previous reporting period); they were spending almost $1,650 more on things like watches than they were during the year prior, further adding steam to the notion that in the wake of the pandemic, consumers are spending more on bigger-ticket items, likely in lieu of spending on social activities, vacations, and apparel.

Fast forward to November 2021 and The RealReal reported that its GMV was up on a month-over-month basis and the average order value had grown further to approximately $514, an increase of 17 percent and 10 percent compared to the same periods in 2020 and 2019, respectively, with watches and women’s handbags among the fastest growing categories for the month.

This embrace by consumers of higher-value, hard luxury items versus more moderately priced ready-to-wear and footwear is now reverting, with Levesque stating that during the most recent quarter, “We saw that consumer shift really back to pre-COVID numbers back in 2019 where that shift of ready-to-wear increased.” While she says the company “expected demand to normalize across categories at some point, it occurred more quickly than anticipated.”

Looking forward, The RealReal anticipates GMV to fall between $430 and $450 million during Q3 and amount to between $1.85 and $1.9 billion for the year, with revenue estimates being between $145 and $155 million for Q3 and between $615 and $635 million for the full year. “Notably,, co-interim CEO Robert Julian stated on Tuesday that management “continue[s] to project that The RealReal will be profitable on an adjusted EBITDA basis in 2024 and we are on track to achieve our Vision 2025 adjusted EBITDA target.”

UPDATED (Aug. 24, 2022): The RealReal reiterated the alleged shift in spending in its latest Luxury Resale Report. “The pandemic ushered in an era that’s seen shoppers spending on high-value bags, watches, and sneakers,” TRR says. “But now, the It investments — and the top brands in luxury resale — are shifting,” with Gucci “regaining its place, and Dior and Balenciaga moving up the chart thanks to mainstay bestsellers, vintage comebacks, and peak cultural relevance.” Still yet, TRR says that “clothing from the archives is skyrocketing as the fastest-growing vintage category, and collectibles like comics, trading cards, and skate decks are attracting buyers in record number.”