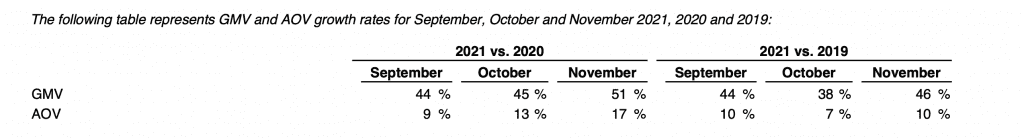

The RealReal revealed this week that it fared well between the two annual shopping days. In the regular monthly business report that it published on Thursday. The San Francisco-based luxury resale player reported that its gross merchandise value (“GMV”) for November (i.e., the value of the goods sold) amounted to approximately $146 million, an increase of 51 percent and 46 percent compared to the same periods in 2020 and 2019, respectively. The company claims that its “strong GMV growth” for the month was driven in part by sales that occurred between Black Friday and Cyber Monday, with 49 percent GMV growth year-over-year during the four-day period.

“Of note,” according to the Nasdaq-traded company, is that this year’s Black Friday was its “largest single day of GMV ever transacted,” a nod, it seems, to analyst sentiments that secondary market occupants are likely to benefit – potentially quite significantly – from significant supply shortage and shipping issues across the globe, and corresponding price hikes (paired with enduring price increases coming out of the luxury sector), which have left consumers facing fewer options when it comes to brand new goods and higher price tags.

(It will be interesting to whether the rise of resale consumption this holiday season – potential due to necessity in light of larger inventory limitations and fewer sales on new offerings – will continue on once the global supply chain quagmire comes to an end; it is not difficult to imagine a more widespread acceptance among consumers of resale as a category in the same way as the pandemic prompted many former brick-and-mortar shoppers to become increasingly more comfortable with and reliant upon e-commerce during COVID shutdowns, and to continue to engage in which shopping behaviors after lockdowns lifted.)

Not only was The RealReal’s GMV up on a month-over-month, the average order value for November grew, as well, to approximately $514, an increase of 17 percent and 10 percent compared to the same periods in 2020 and 2019, respectively, with watches and women’s handbags among the fastest growing categories for the month.

Overall, The RealReal revealed in its Q3 earnings call last month that its business is “back to normal, pre-COVID,” and in fact, “everything is either better than where we were pre-COVID or back to normalcy.” Among the categories that has bounced back is apparel, which slowed significant during the pandemic, with founder and CEO Julie Wainwright stating that the company is “still selling a huge mixture of high value handbags and fine jewelry,” demand for which largely endured over the past two years.

Commenting on the holiday season this year, Wainwright said that the company has had “really robust supply coming in from our consigner base, which we didn’t have before.” Meanwhile, in response to an analyst inquiry, The RealReal President Rati Levesque said that there is not anything worth “flagging” when it comes to the company’s growing vendor transactions (i.e., transactions with brands and/or retailers as part of its B2B vendor program, which TFL first reported on back in 2018) to secure additional product for the holiday. Levesque noted that the vendor side of things is “a driver for high value for us,” namely, by way of “fine jewelry, watches, [and] handbags,” and says that the company expects to “continue to see that trend for the holiday.”

Successful sales for The RealReal during the Black Friday, Cyber Monday weekend are noteworthy, as online sales during the annual shopping weekend came up a bit short this year. According to data from Adobe Analytics, with e-commerce sales on Friday falling by 1.1 percent to the same day in 2020, and Cyber Monday sales dropping by 1.4 percent compared to last year, the first-ever drop recoded by Adobe since it started tracking e-commerce spending on major shopping days in 2012. (It is worth noting that in-store sales did not suffer on Black Friday and in fact, sales in brick-and-mortar stores were up by almost 43 percent, per Mastercard SpendingPulse.)

Also on the up this year? Amazon, which reported that it generated “record-breaking” sales between Black Friday and Cyber Monday, without disclosing actual figures.