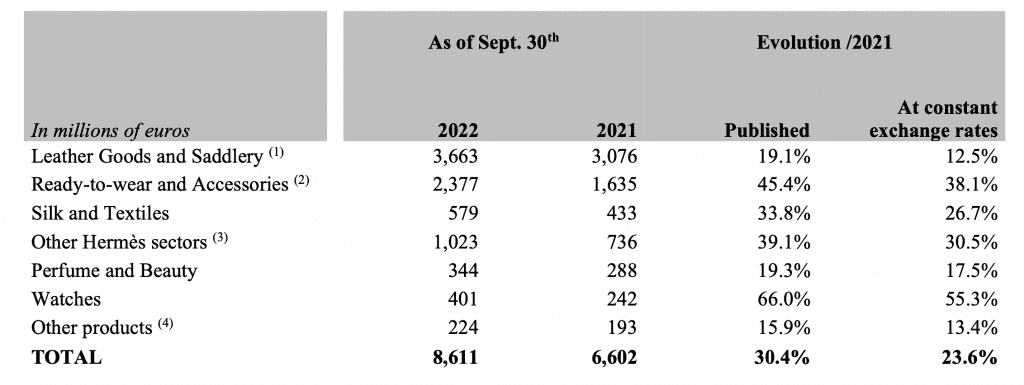

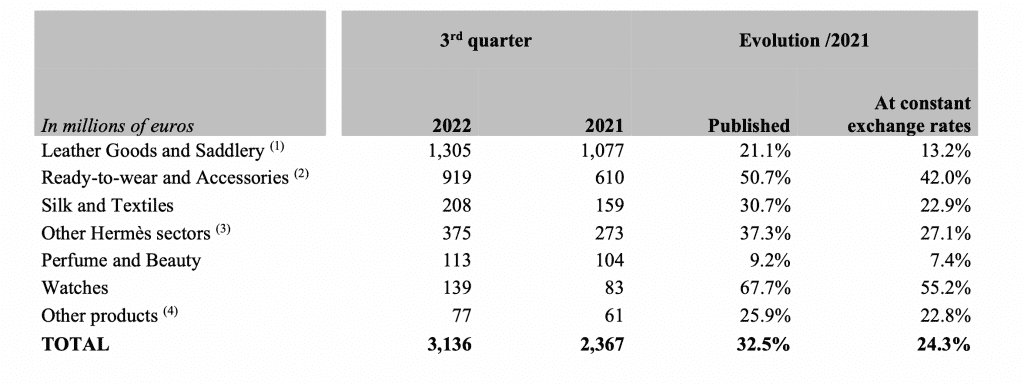

Hermès touted “very good sales momentum” for the third quarter generating 3.1 billion euros ($3.03 billion) for the three-month period ending on September 30 (up 24 percent year-over-year – significantly greater than the analyst consensus of 15.3 percent), “with strong growth in all the business lines,” and 5.5 billion euros ($5.38 billion) in revenue (up 23 percent at constant rates) for the first nine months of the year. The French group highlighted “high levels of sales” across all of its groups, with the Ready-to-wear and Accessories, Watches and “Other” divisions posting “a remarkable increase in the third quarter.”

Looking at the individual categories, Hermès’s mighty Leather Goods and Saddlery division, which saw revenue rise to 1.3 billion euros ($1.27 billion) in Q3 up by 13 percent (despite the usual limits on output), benefitted from “the strong rebound in Greater China in Q3 and very sustained demand,” according the the group Hermès. Leather Goods and Saddlery sales for the first 9 months grew by 12.5 percent to 3.7 billion euros ($3.62 billion). Ready-to-wear and Accessories sales were up by 38 percent in Q3, driven, in part, by the “great success” of fashion accessories.

Watch sales grew by 55 percent “thanks to the development of pieces with exceptional know-how, such as the Arceau, Le temps voyageur watch and the success of the new H08 watch.” And still yet, “Other” Hermès sectors were up by 31 percent in Q3 due to “highly dynamic growth, both in Homeware and Jewelry.”

Sales in the group’s stores were up 23 percent in Q3, per Hermès, while a 26 percent rise in wholesale activities “reflected the resumption of travel retail.” At the same time, Hermès management said on a call on Thursday that growth in s-commerce sales continues to outpace brick-and-mortar across all regions.

Geographically speaking, all the areas posted very strong performances as of the end of September, according to Hermès. Highlights here include … Asia excluding Japan (+21 percent) continued its “strong momentum,” thanks to a 34 percent rise in sales for Q3. Sales in Greater China “picked up strongly, despite temporary closures,” resulting in what the group says is a “spectacular” recovery, particularly in Beijing and Shanghai, with sales driven by organic growth and not the result of price increases.

Japan (+21 percent) confirmed “the regularity and solidity of its growth, thanks to the loyalty of local clients.” Americas (+28 percent) continued on an upward trend in Q3. Europe excluding France (+25 percent) and France (+28 percent), supported by “the loyalty of local customers, benefitted from the recovery in tourist flows, especially in France, the United Kingdom and Italy.”

Hermès has the “lowest impact from tourism” compared to its luxury peers, according to Neev Capital managing director Rahul Sharma. So, its regional results “directly show strength by nationality.”

Looking ahead, management says that price increases are coming, with the company slated to boost prices by 5 to 10 percent in January to make up for increased materials and labor costs, particularly in Europe. Hikes are expected to be smaller in the U.S., China, and Singapore compared to the EU and Japan. These annual increases follow from a 4 percent jump put in place early this year – that is up from the usual 2 percent annual rise in recent years).

Another forward-facing point centers on Hermès’s supply chain, with management revealing that there may be issues in Q4, as vendors “under pressure from inflation and the sourcing of raw materials.,” which may result in delays. Nonetheless, in light of the fact that Hermès is “hiring at full steam” and handing out “bonuses/raising wages for all staff,” Sharma asserts that we “could not get more positive signals about the health of the business.”