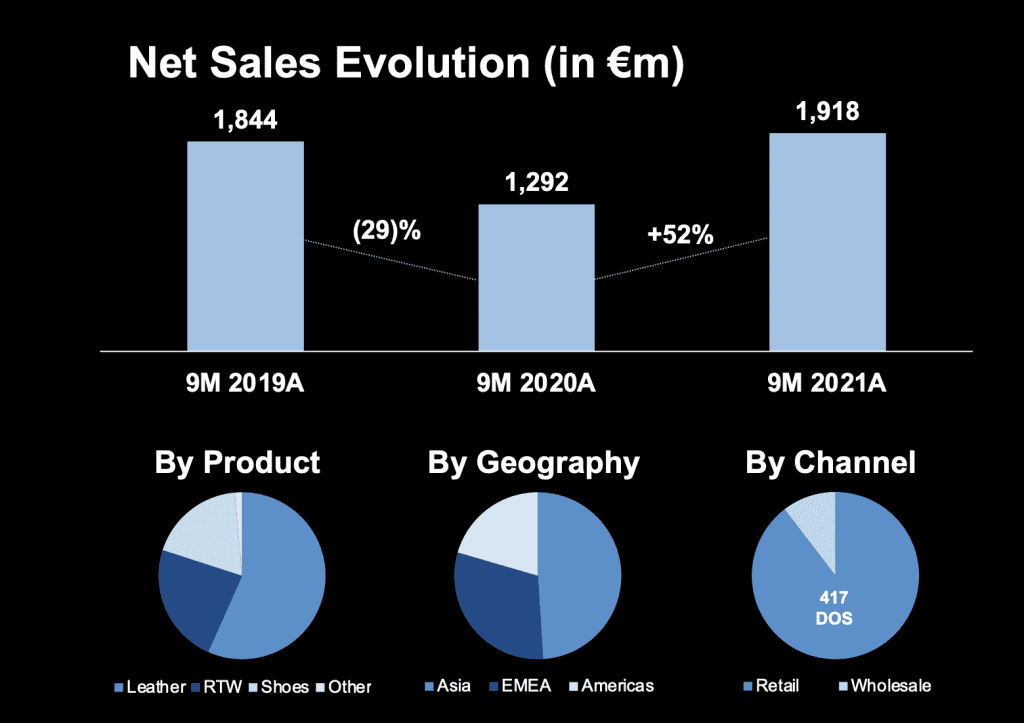

Prada generated 1.92 billion euros ($2.18 billion) in sales during the first nine months of 2021, the Milan-based group revealed during its Capital Markets Day on Thursday, a boost of 52 percent compared to the first 9 months of 2020, and up 4 percent compared the same period in pre-pandemic 2019. Third quarter retail sales – which rose by 18 percent compared with the same period of 2019 – were helped along, in large part, by the almost doubling of sales in the Americas market, and more than 400 percent gains in online sales growth for the three-month period compared to Q3 in 2019.

Focusing primarily on its “strategy for long-term growth” in its presentation on Thursday, Prada outlined a number of key steps that it “has taken to navigate the evolving luxury market,” including those that come as part of a larger quest to move the Prada brand more upmarket. This has seen the brand “increase product content, quality and uniqueness,” and “adapt pricing accordingly,” while also eliminating markdowns, something Prada’s management has been working on since 2019 when it announced that it would do away with price cuts in order to “strengthen the brand’s image and in particular, guarantee higher margins.”

Beyond that, the Hong Kong-listed group revealed that it has focused on – and “strengthened control of” – its direct distribution in order to increase store productivity and online penetration. And at the same time, it has developed what it says is “a fully integrated e-commerce platform,” growing its online penetration to 7 percent of retail revenue up from just 2 percent in 2019.

On the product front, Prada stated that it has continue to increase the value of its offerings and the average price (it raised prices by an average of 13 percent globally in 2020, according to a report from Deloitte), but also maintaining “a broad price architecture,” presumably in an attempt to cater to a wide pool of consumers even as its moves upmarket. Reflecting on the first nine months of the year, Prada stated that growth across all product categories is “above 2019 levels,” and noted that it is aiming to balance growth across product categories. While Prada did not break out exact sales figures for its different product categories, it appears (from the charts it shared) that just over half of its 9M 2021 revenues came from sales of leather goods, followed by an almost even split between ready-to-wear and footwear. In terms of revenue by region, sales in Asia amounted to almost 50 percent, followed by EMEA and then the Americas.

Looking ahead, Prada states that it is aiming to boost annual revenues to 4.5 billion euro ($5.11 billion) for the “medium-term,” with an operating margin target of approximately 20 percent. In furtherance of this, the group is angling to double its online penetration to 15 percent of retail revenues and increase retail sales density by 30 percent to 40 percent.

Shedding light on how it plans to achieve such growth, Prada revealed that from a brand point of view, it is aiming to “consolidate strong awareness by leveraging its brand pillars,” and boost its marketing investment in digital and experience in order to “sustain and convert customers focus.” (From a brand perspective, it is worth noting that Prada has seemingly increased its focus on its trademark triangle in recent seasons, in particular, (including a streamlined version) which landed the triangle on Lyst’s 2021 Year in Fashion report as the “most searched for” logo.)

In terms of product, Prada is “investing in iconic products and newness” simultaneously, including by launching new categories, such as beauty, fine jewelry, and home goods, and doubling down on its sportswear-centric Linea Rossa collection in order to achieve “full potential” there. Finally, Prada plans to accelerate within the customers pools that are driving market growth, namely, Gen-Z buyers, as well as those in China and the U.S.

And finally, no shortage of the presentation focused on the role of sustainability in the Prada model, with the group unveiling what it called “an ambitious climate strategy,” as well as the proposed appointment of two Environmental, Social and Governance experts – consultant Pamela Culpepper and Corporate Sustainability VP of Japan Tobacco International Anna Maria Rugarli – to the Board of Prada S.p.A to further ESG strategy and practices. Culpepper and Rugarli will “advance the Group’s ESG strategy and practices and they will also be part of a new ESG Board Committee alongside Lorenzo Bertelli, Head of Corporate Social Responsibility.”

The latest report comes after Prada revealed this summer that sales for the first half of the year grew by 60 percent at constant exchange rates to 1.5 billion euros ($1.78 billion), and up by 8 percent compared to the same period of 2019, results that have enabled the brand to beat analyst expectations of 1.44 billion euros. Breaking down the results of its individual brands, Prada reported that it saw “very sharp” two-year growth in sales for its namesake label – which generates 86 percent of the group’s revenue. Prada’s sales were up by 13 percent compared to H1 in 2019 and 64 percent compared to H1 in 2020, with “all categories” driving growth. At Miu Miu – which sees 13 percent of the groups’ sales – revenue was actually down by 8 percent compared to H1 in 2019, but up by 43 percent compared to H1 in 2020.