Fashion industry executives point to forced labor, an uncertain economy, shipping and supply chain disruptions, and rising geopolitical tensions as among their key concerns this year, according to a new survey. They also cite the growing costs that stem from – and concerns about compliance with – the rise in sustainability-centric regulations in the European Union and beyond, with no shortage of respondents revealing that their companies are devoting greater resources to “sustainability and social compliance” related efforts.

In furtherance of its eleventh annual “Fashion Industry Benchmarking Study,” the U.S. Fashion Industry Association (“USFIA”) sought to gauge the business outlook, sourcing practices, and trade policy views of fashion industry executives. After surveying executives from 30 leading U.S. fashion brands, retailers, importers, and wholesalers between April and June of this year, the USFIA identified the top five business challenges facing companies in the fashion segment in 2024 as: (1) inflation and economic outlook in the United States; (2) managing the forced labor risks in the supply chain; (3) shipping delays and supply chain disruptions; (4) managing geopolitics and other political instability related to sourcing; and (5) the protectionist trade policy agenda in the U.S.

Delving into these findings, the USFIA stated …

> Inflation and economic outlook in the U.S. – This is a key concern for “nearly 40 percent of respondents,” which the USFIA says “far exceeds other concerns.”

> Managing forced labor risks in the supply chain – This ranked as the second top business challenge in 2024, with nearly half of respondents rating the issue as one of their top five concerns. “Notably, forced labor-related trade enforcement has been a priority for U.S. government agencies regarding textiles and apparel products since implementing the Uyghur Forced Labor Prevention Act (“UFLPA”) in June 2022,” according to the USFIA. Respondents broadly call for “greater transparency in U.S. Customs and Border Protection’s UFLPA enforcement, specifically in shipment detention and release decisions,” and suggest that, among other things, Customs should “focus on ‘bad actors’ only [and] clarify enforcement on recycled cotton.”

The trade group notes that over 80 percent of respondents are “intentionally reducing sourcing from high-risk countries,” including China, while “another 75 percent of respondents explicitly state that their company has ‘banned the use of Chinese cotton in the apparel products’ they carry.’” At the same time, about 45 percent are “exploring sourcing destinations beyond Asia to mitigate forced labor risks, with fewer respondents planning to cut apparel sourcing from Asian countries other than China directly.”

Still yet, in light of labor-related risks, more than 90 percent of respondents say they are “making more efforts to map and understand their supply chains, including the sources of fibers and yarns contained in finished products.” Notably, the USFIA found that “nearly 90 percent” of respondents report mapping their entire apparel supply chains from Tier 1 to Tier 3 in 2024, a significant increase from about 40 percent in the past few years.

> Shipping delays, supply chain disruptions & political instability related to sourcing – These are also key issues for respondents, with at least one respondent stating that “logistics and logistical hiccups continue to be a big concern (e.g., ‘the Red Sea situation is leading us to exit Kenya and most of Egypt in the next year’).” Meanwhile, others highlighted “the deteriorating U.S.-China bilateral relationship” as “deeply concerning” and cited plans to further “reduce China exposure” to mitigate risks. Nearly 80 percent of respondents say they “plan to reduce their apparel sourcing from China further over the next two years through 2026,” with U.S. fashion companies “actively exploring new sourcing opportunities, with a particular focus on emerging destinations in Asia and the Western Hemisphere.”

While environment, social, and governance (“ESG”) and sustainability-related issues were not explicitly listed as among companies’ “top business challenges,” they were, nonetheless, a recurring theme in the statements made by respondents. A few key points stand out to me with regard to ESG and sustainability…

> Rising costs of regulation, sustainability – Similar to last year’s results, the USFIA says that large companies with 1,000+ employees generally hold a more optimistic financial outlook than relatively small ones with fewer than 1,000 employees. “This disparity is likely driven by the substantial financial resources required to navigate the shifting sourcing landscape, meet new regulatory requirements, and invest in sustainability and technology – costs often beyond the affordability of small and medium-sized fashion companies.”

> Compliance with ESG regulations – Over 70 percent of respondents said they anticipate the “cost related to compliance with factory, social and environmental regulations” to increase further in 2024, with 14 percent expecting a “substantial increase.” As a growing number of new social and environmental regulations affecting fashion apparel products take effect at federal, state, and global levels and as enforcement intensifies, U.S. fashion companies could face even higher compliance costs in the coming years.

> ESG-related hiring – Over 90 percent of respondents said they plan to increase hiring over the next five years. The three positions with the highest demand among respondents from 2024 through 2029 include “Environmental sustainability-related specialists or managers,” “Social compliance-related specialists or managers,” and “Data scientists.” The high demand for these positions “reflects U.S. fashion companies’ increasing commitment to sustainability and social compliance and the growing complexity of these issues that require talents with professional knowledge and expertise,” the USFIA says.

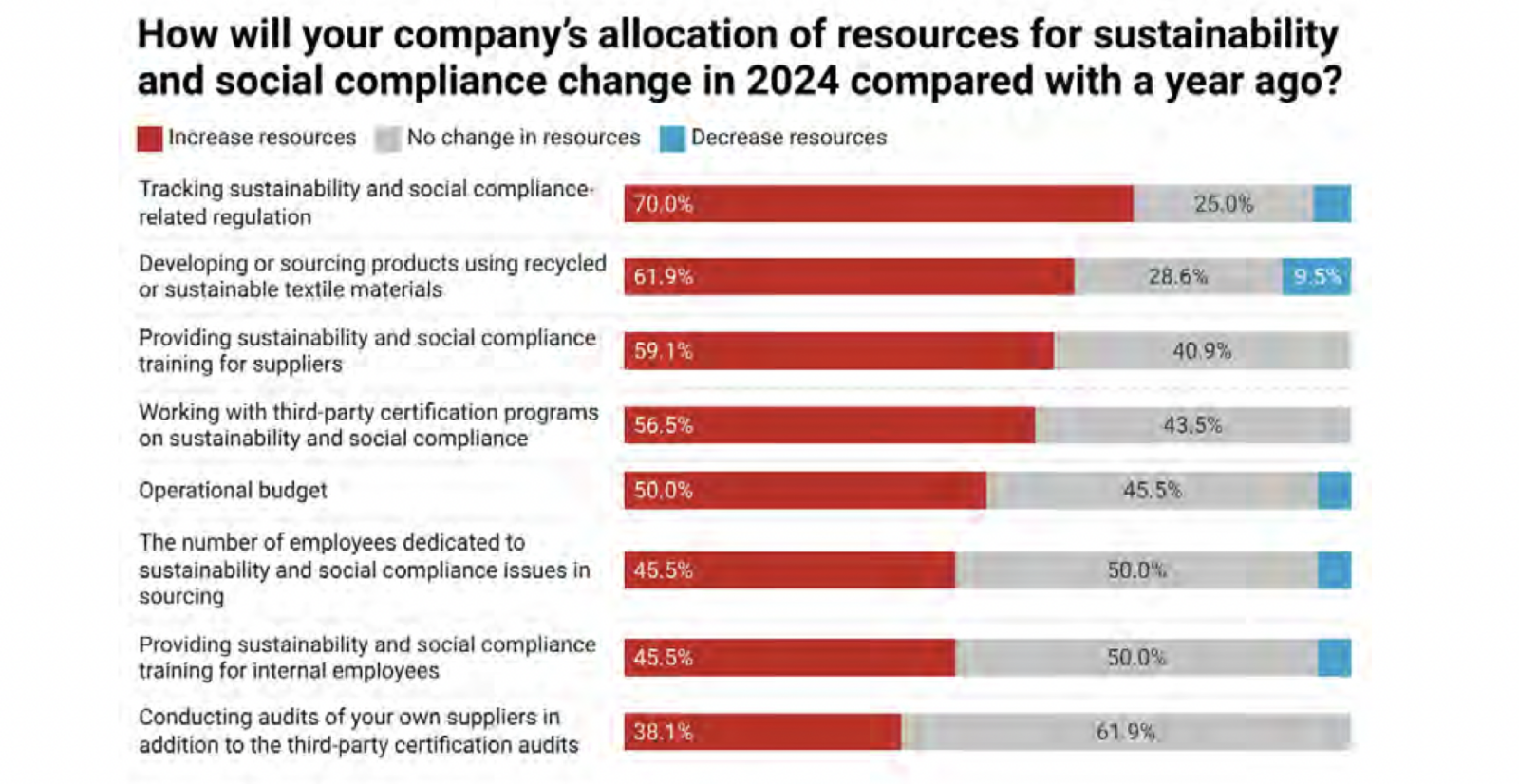

> ESG compliance – As legal requirements, industry standards, and consumer expectations continue to evolve in the sustainability and compliance area, the USFIA found that “over half of the respondents plan to further strengthen ‘Sustainability and social compliance training for suppliers,’ ‘Sustainability and social compliance training for internal employees,’ and ‘Working with third-party certification programs on sustainability and social compliance’ in 2024.”

> Sustainability and social compliance-related regulation – Finally, from the forced labor import ban, Extended Producer Responsibility legislation, and the New York Fashion Act to the EU’s Corporate Sustainability Due Diligence Directive, the USFIA states that “more and more legislation addressing sustainability and social and environmental compliance issues in the fashion industry are newly adopted or introduced in the United States and globally.”

Since these new regulations “could significantly affect fashion companies’ sourcing and other business practices, 70 percent of respondents plan to allocate more resources to ‘tracking sustainability and social compliance-related regulation’ this year, making the issue the top priority in the sustainability and compliance area.”