All eyes are on Gucci as Sabato De Sarno made his creative directional debut for the Italian fashion brand in Milan on Friday. Not only are creative reinventions like this “fraught with risk,” as Bernstein’s Luca Solca put it earlier this year, the stakes are especially high given the sheer size of Gucci – it is one of the segment’s > €10 billion mega-brands and its corresponding importance to Kering. At the same time other factors are ratcheting up the pressures, including enduring management reshuffling at Kering, including former Gucci CEO Marco Bizzarri’s exit, the repositioning of Francesca Bellettini who will now have all of Kering brands’ CEOs reporting to her in addition to staying in her chief executive role at Yves Saint Laurent, etc.

Beyond that, Reuters pointed to the fact that despite being “one of the biggest success stories in fashion in recent years,” Kering’s largest brand has “struggled to capitalize on a post-pandemic rebound that fueled surging sales at rivals, such as LVMH-owned Louis Vuitton and Dior.” And still yet, there is the state of the luxury market – which is not making the turnaround that brands had hoped for. The consensus among leaders at fashion/luxury’s big groups is that if 2023 has been difficult, 2024 is going to be even worse – making it go time if brands want one last chance to right their ships ahead of further slowdown. 40-year-old De Sarno’s debut is particularly important in this sense, as Gucci is suffering from brand fatigue and needs something new – and big – to regain consumers’ attention and interest, especially as many are expected to continue to pull back on their spending.

One need not look further than China for some obvious indicators on this front. A recent report from Barclays was less than optimistic about the return to spending by the all-important Chinese consumer, with the firm’s analysts lowering their guidance for LVMH – and by extension, the luxury sector as a whole. “The luxury goods sector has been going through a severe de-rating over the past month, which we think reflects the deteriorating macro indicators coming from China and the gradual return to more normalized growth,” the Barclays analysts stated.

> Other figures coming out of China suggest that a shift is underway. A survey of more than 4,500 Chinese consumers from Shanghai Jiao Tong University’s Advanced Institute of Finance and Charles Schwab revealed that only 28.6 percent of people – “newly rich” individuals from first- to third-tier cities – said that luxury spending was a financial goal of theirs. This is down more than 50 percent from 2018.

> This comes on the heels of a note from Citi analysts this summer, who stated – around the same time that Cartier-owner Richemont released a les-than-stellar sales update – that China will “not be going through a V-shape demand recovery but rather a multi-year consumption catch-up at home and abroad.” At the same time, Agility’s managing director Amrita Banta said that “there is a level of not feeling entirely comfortable with their future economic position that is really affecting almost everybody in China,” and that is impacting luxury brands.

> At the same time, the post-pandemic spike in luxury goods sales in the U.S. is neutralizing. The industry’s biggest groups have reported slower sales growth in the U.S., which is the luxury segment’s other most meaningful market. Jacques Guiony, chief financial officer of LVMH, for instance, said this summer that growth in the U.S. is “not as good as it was.” And Richemont reported a 4 percent drop in quarterly sales in July, with chief financial officer Burkhart Grund telling analysts that while sales had begun to pick up for the group in June, it is “not out of the woods” yet. Specifically, Grund noted that company is cautious ahead of 2024, particularly given that it is an election year in the U.S., which tends to have “a damping effect on luxury demand.”

Not all is lost. In fact, in a recent note, Bernstein analysts seemed optimistic that Gucci can pull off a revamp despite a currently-tepid market, stating that Kering has a “way” and a “track record of systematically successful brand reinventions.” The Kering “secret sauce,” according to Solca, is “a combination of daring creativity, merchandising canning, and fast, ‘all in,’ broad front execution across functions.” Case in point: It did it with Gucci under the direction of former creative director Alessandro Michele and Bizzari.

Analysts at RBC echoed this sentiment, saying in a note that they believe that “the quiet progress being made on product, price and merchandising [at Gucci]” – namely, the company’s move away from entry-level items and introduction of higher-price-tag wares – “sets the right foundation for Sabato De Sarno’s new chapter at the brand.”

As for what it is shaping up to be this time around, De Sarno said ahead of his debut that he “want[s] people to fall in love with Gucci again,” which is why he is using the word “ancora” in connection with his first show. “Ancora means a lot of things,” he told Vogue. “It means again, but it’s also more personal; it’s not something you lost, it’s something that you still have, but you want more of it because it makes you happy.”

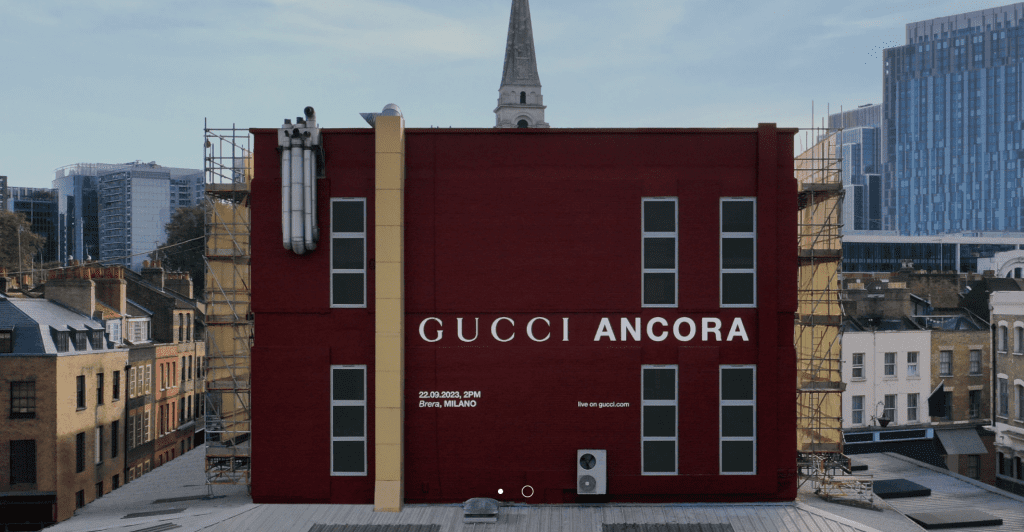

Gucci has taken early steps from a branding/trademark perspective. The company splashed the GUCCI ANCORA name and a burgundy red color across the globe via large-scale advertising campaigns – projecting it on the sides of buildings in New York, Paris, and London; on sky-scraping towers in Chengdu; on cable cars in Milan; and in newspapers and magazines, etc. It has also filed two U.S. applications for registration for the GUCCI ANCORA word mark and another version that consists of “the stylized wording ‘GUCCI’ in white to the left of the bold stylized wording ‘ANCORA’ in white, all on a dark red background” for use across more than a dozen classes of goods/services – from clothing and leather goods to video games (Class 28) and homewares (Class 21 and 24).

In terms of the trademarks that went down the runway, the staples were at play. The opening look, for example, was styled with an interlocking “G” belt buckle, horsebits could be found on platform footwear (which Gucci will undoubtedly gift and sell a lot of) and Jackie bags, and there were some green-red-green motifs dotted across handbags straps, sneaker tabs, the waistband of shorts and/or the collar or wrists of tops. Meanwhile, the GUCCI word mark found its way onto a gray hoodie, which was paired with shiny monogram-printed shorts, and onto the breast of tops.

> Still yet, the bold use of the burgundy red hue is worthy of note in light of companies’ seemingly increasing focus on color branding. Just last week, Burberry, for example, splashed a blue hue across everything from a tube station and a pop-up at Norman’s Cafe in London to the soles of shoes that went down its runway. While signature colors are far from a novel element of branding, in the wake of Bottega Veneta having so much success with its green, a growing number of brands seem to be pushing their own colors as a way to garnered consumer attention in a market that is crowded with more traditional branding.

As for early feedback of the collection, it has been focused on the traditional “spring cleaning” that tends to play out between creative directors’ tenures. “Gucci’s new creative director made his long-awaited debut in Milan on Friday, offering a timeless, feminine collection with the aim of relaunching the luxury brand,” the AFP reported. The New York Times’ fashion director Vanessa Friedman noted that De Sarno used his debut to “wip[e] the slate (mostly) clean.” Reuters reflected on De Sarno’s “glamorous, skin-baring lineup of minimalist designs,” including “short shorts paired with suit jackets, jewel-encrusted garments and tank tops with plunging neck lines.” And finally, FashionNetwork posited that bra tops might be the new handbag given “how many bras in crystal, strass, and beading [De Sarno] sent out.”