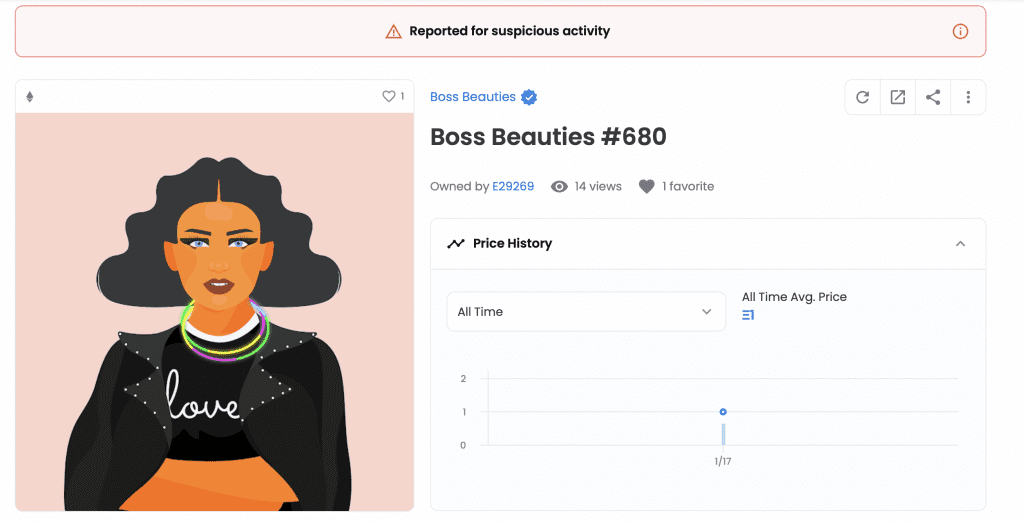

Non-fungible tokens (“NFTs”) may potentially be treated in the same way as other proprietary assets for the purpose of legal remedies, a recent decision from a court in the United Kingdom has confirmed. In what is being characterized as a “landmark” development in the realm of NFTs, the High Court of England ordered that an urgent interim injunction be put in place to prevent any further transfer of two NFTs from the Boss Beauties collection (including Boss Beauties #680) for the duration of a pending misappropriation lawsuit that blockchain and fintech consultant Lavinia Osbourne filed against Ozone Networks, which does business as NFT marketplace OpenSea, earlier this year.

In the complaint that she filed with the High Court of England and Wales in March, Osbourne claims that two Boss Beauties NFTs were removed from her MetaMask crypto wallet without her authorization in January, prompting her to file suit against OpenSea, as well as the unidentified individuals behind the two accounts that currently hold the stolen NFTs. In an initial ruling on March 10, the court issued an order requiring that the NFTs be frozen and thus, prevented from being be sold and/or transferred on the OpenSea platform. And in a subsequent ruling dated March 31, Judge Mark Pelling QC granted another injunction, which is slated to remain un effect until further order. In addition to requiring that the NFTs be frozen, the court has called on OpenSea to provide identifying information about the two account holders.

In the critical part of his order, Judge Pelling states, “There is clearly going to be an issue at some stage as to whether non-fungible tokens constitute property for the purposes of the law of England and Wales, but I am satisfied on the basis of the submissions made on behalf of the claimant that there is at least a realistically arguable case that such tokens are to be treated as property as a matter of English law.”

While there have been “several instances in recent years [in which] the High Court has frozen stolen cryptocurrency,” according to Racheal Muldoon, a lawyer on 36 Commercial’s Cyber Law Team who is representing Osbourne, this case is “believed to be unprecedented, with the courts taking the step of freezing NFTs as a specific class of crypto assets, as distinct from cryptocurrency due to their non-fungible unique nature.” Against that background, the injunction is expected to have a significant impact on future cases in the space, Muldoon told the Art Newspaper, including by “removing any uncertainty that NFTs (as tokens consisting of code) are property in and of themselves, distinct from the thing they represent (e.g., a digital artwork), under the law of England and Wales.”

Beyond securing the NFTs at issue in the case, the court’s decision serves to “provide additional legal protections for NFT owners” more broadly in what is “an otherwise unregulated sector, where the already high number of hacks and scams is growing,” according to Signature Litigation attorneys Kate Gee and Alasdair Marshall.

OpenSea, alone, is currently facing a growing number of negligence and breach of contract lawsuits in the U.S. in connection with a widely-reported phishing attack that reportedly cost users of the marketplace millions of dollars in stolen NFTs, including Bored Apes, early this year. Those cases allege that despite having “full knowledge” that security issues were putting its platform and the tens of millions of NFTs listed on it at risk, OpenSea “did not properly inform its users and did not timely put adequate safety measures in place” leading up to or in the immediate wake of the February 2022 attack.

Meanwhile, fellow marketplace LooksRare is similarly facing multi-million dollar negligence litigation, with Plaintiff Robert Armijo, whose Bored Ape Yacht Club and Mutant Ape Yacht Club NFTs were stolen and subsequently listed for sale on LooksRare, arguing that NFT marketplaces “have an incentive to allow NFTs to be bought and sold as many times as possible because they profit from every transaction that occurs in their marketplaces.”

“This judgment sets out an important precedent in recognizing the legal status of NFTs as property and will enable NFT owners to take steps to regain some control of their NFTs and ensure they are not further dissipated during recovery proceedings,” per Gee and Marshall, who note that “there is a growing body of case law recognizing cryptocurrencies as property, but the legal recourse and regulation covering other crypto assets, including NFTs, is largely uncertain (or non-existent).”

The case is Lavinia Deborah Osbourne v. (1) Persons Unknown and (2) Ozone Networks Inc.