Companies’ revenues and projections for growth are not the only things being heavily affected by the onset and enduring impact of COVID-19. The intangible value of the world’s biggest companies by total intangible value has not been immune to such volatility. In fact, according to a recent report from Brand Finance, the value of the intangible assets of some of the world’s most valuable companies “started at $7.2 trillion, then dropped by just shy of $1 trillion during the [immediate] COVID-19 crash,” and more recently recovered, “skyrocketing to a total of $10.8 trillion as of September 1.”

In furtherance of its ongoing aim to put a dollar valuation on the disclosed and undisclosed intangible assets of the world’s largest companies, including their “rights, relationships and intellectual property,” Brand Finance found that the top 10 companies that are the most valuable when it comes to intangibles include Apple, Amazon, Aramco, Microsoft, Alphabet, Facebook, Alibaba, Tencent, Tesla, and VISA, respectively. Reflecting on the occupants of this year’s top 10 list, which are responsible for more than $10 trillion in value, Brand Finance states that the “very nature of the internet & software and technology & IT sectors,” in particular, which represents the companies at the top of the list, “means they are heavily reliant on intangible assets.”

“These companies have the ability to differentiate themselves with limited physical assets, defending price and demand,” with 32 internet & software and technology & IT companies included in the top 100 ranking of companies with the highest total intangible value – versus 25 just one year ago. Or as The Street’s Samanda Dorger put it, “Globally, the value of these assets has ballooned along with the internet, and the growth of this digital economy has dramatically changed the way companies are valued: value is increasingly derived from digital platforms, software and other intangible investments rather than physical assets like real estate” – which has becoming glaringly obvious in connection with the rising number of retail bankruptcy acquisitions – “oil wells or other capital.”

At the same time, Brand Finance notes that “cosmetics, pharma and healthcare companies continue to be highly intangible, due to the combined impact of branding and technology, which play a critical role in value-generation for these industries.”

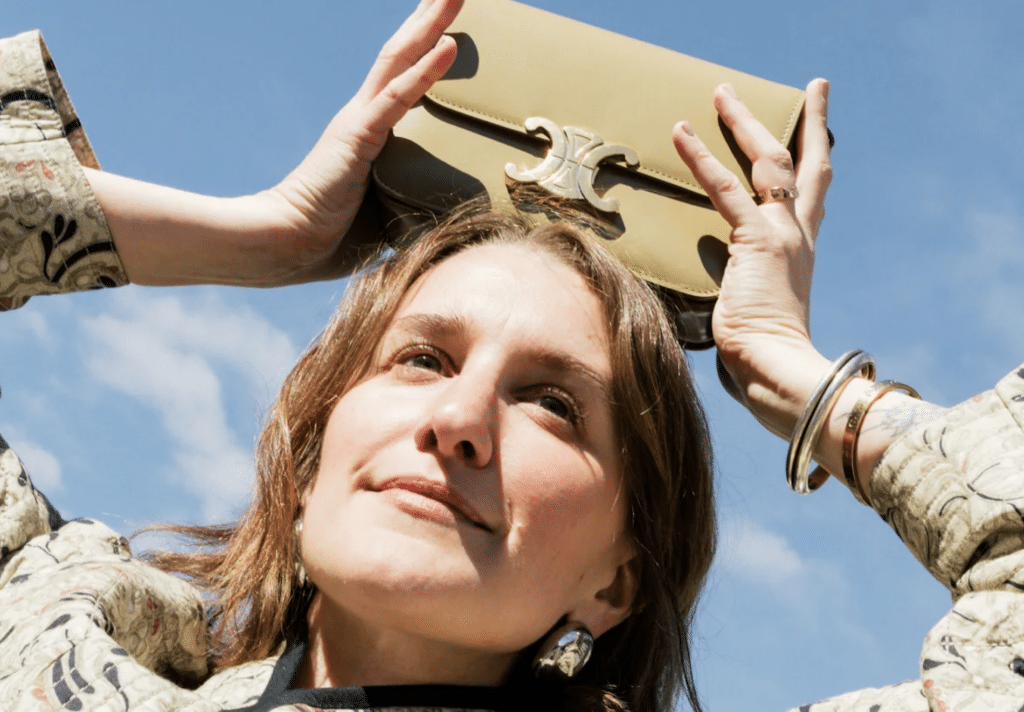

A few apparel and cosmetics companies made it onto the list this year. LVMH Moët Hennessy Louis Vuitton, for instance, sits in the number 31 spot (down from its number 30 spot in 2019). The Paris-based luxury goods conglomerate – which owns upwards of 70 luxury brands, including Louis Vuitton, Dior, Celine, Givenchy, and Loewe – has a total intangible value $233 billion, according to Brand Finance’s calculations, with that total intangible value accounting for 88 percent of the company’s overall enterprise value (i.e., the company’s total value).

Nike took the number 49 spot, up from 64 in 2019, with a total intangible value of $172 billion, which represents 94 percent of the company’s enterprise value, and cosmetics giant L’Oreal landing in the number 55 spot (down from 53 last year). Its total intangible value reached $166 billion this year, which is 90 percent of its enterprise value.

Brand Finance says that the “enormous volatility” not only in the market but more specifically in terms of the intangible value of the world’s biggest companies, as tied to “COVID-19, Brexit, a negative oil price, and the rollercoaster of Biden vs Trump,” suggests that there are “fundamental flaws in investor understanding of company assets.” Given that 2020 has been “considered to be the most volatile year since 1929,” the London-based business valuation consultancy asserts that “most investors do not fully understand the underlying value of the companies they invest in, leaving room for wildly fluctuating share prices and mass panic.”

Looking ahead, Brand Finance contends that “share prices are inevitably going to be volatile due to varying perceptions of organizational strengths.” The companies that have “gained the most this year are those with excellent management of intangible assets.” With that in mind, Brand Finance states that “companies should continue to invest in unique technology, capabilities, and strong brands to succeed,” while also noting that “the most valuable partnership a company can form is between innovation and reputation.”