Nike is among the highest-rated names on the latest version of a ranking of companies by the “completeness of [their] withdrawal” from the Russian market, while names like Alibaba, Diesel, Tom Ford, and Armani allegedly score poorly. After first compiling and publishing a ranking of companies’ responses to the Russian invasion of Ukraine (and the subsequent levying of sanctions by governments) in February, the Yale Chief Executive Leadership Institute (“CELI”) has released an updated ranking this month of what it claims is the current state of companies’ operations, with over 1,000 companies “voluntarily curtail[ing] operations in Russia to some degree beyond the bare minimum legally required by international sanctions,” but some companies – including fashion/luxury names “continu[ing] to operate in Russia undeterred.”

A the top of the September 14 ranking are companies that CELI characterizes as “totally halting Russian engagements or completely exiting Russia.” These companies largely consist of “financials,” “materials,” information technology,” and “industrials” firms (the latter of which includes management consultancies, law firms, etc.), but also extends to the likes of Nike (which is “exit[ing] Russia,” per CELI), Etsy (“deactivate[d] all listings from Russian sellers”), Ikea (“fold[ed] up Russian presence”), French cosmetics brand L’Occitane (“exit Russian operations”), off-price retail group TJX Cos. (which “divest[ed] its Familia subsidiary”) and French automaker Renault (“sold Renault Russia; transfer[ed] Moscow factory to city government and partner for local brand production”), among others.

According to the CELI’s data, a total of 315 companies are included in this category, which carries with it an “A” rating.

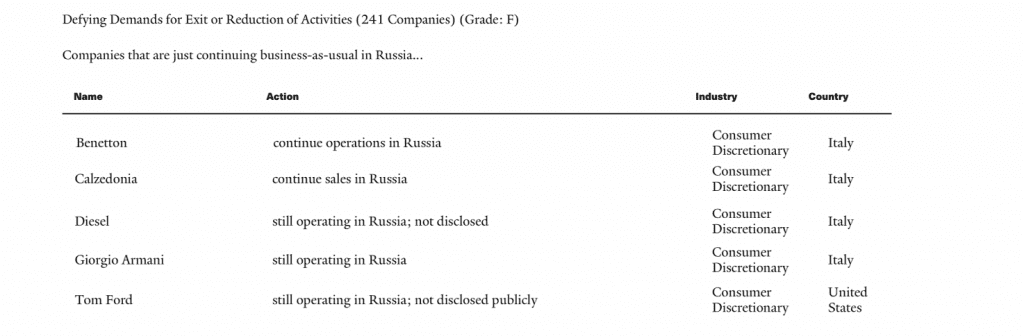

At the other end of the spectrum are companies that CELI labels as “continuing business-as-usual in Russia,” i.e., companies that are “defying demands for exit or reduction of activities.” Included in the 241 companies that are labeled as such: Chinese sportswear company Anta Sports and Chinese e-commerce giants Alibaba and JD.com. A handful of Italian fashion names are assigned an “F” rating, including Benetton, which has allegedly “continue[d] operations in Russia;” Calzedonia, which has “continued sales in Russia;” Diesel, which is “still operating in Russia [but has] not disclosed” that, per CELI; and Giorgio Armani, which is “still operating in Russia.”

French fashion company Lacoste is also “still operating in Russia,” per CELI, as are U.S.-headquartered Quiksilver, which allegedly has “online sales still running,” and Tom Ford, which CELI claims is “still operating in Russia; not disclosed publicly.” (It is noting that Tom Ford’s operations are almost certainly limited to those of its Italian eyewear licensee, Marcolin; the company has not yet responded to a request for comment.)

Armani said in a statement that it “does not operate directly in Russia and the shops operating in the country with the brands of the group are managed by independent franchisees,” which is the norm for most brands when it comes to their presence in the Russian market. The company asserted that it maintains “strict compliance [with] the sanctions regime issued by the EU.” Diesel similarly revealed that it does not maintain brick-and-mortar stores in Russia and that it has ceased its e-commerce sales there. The Italian brand “stressed that … it was respecting the sanctions while noting that they do not apply to products selling for less than €300,” according to The Economist’s Italy correspondent John Hooper.

Meanwhile, the likes of cryptocurrency exchange platform Coinbase (which “block[s] certain illicit Russian accounts but not all”); Fortnite-creator Epic Games (which has “stop[ped] in-game commerce for Russia;” Gap (whose “online sales [are] running; stopped shipments to franchisees in Russia”); Skechers (which has “suspended shipments to Russia but online sales continue”); and Mayhoola-owned Valentino (which has “suspend[ed] online sales; no information about on-site sales”) have been assigned a “C” grade “for scaling back some significant business operations but continuing some others.” (170 companies have been given a “C” rating by CELI.)

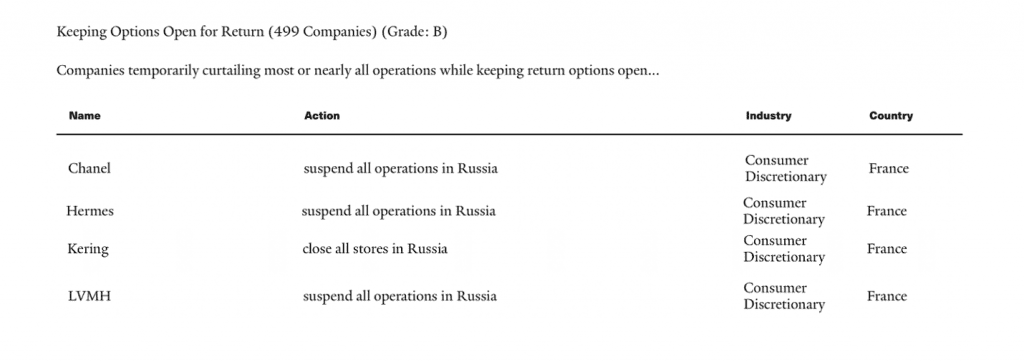

The highest number of companies (499) are situated within the “B” tier, which refers to companies that are “temporarily curtailing most or nearly all operations while keeping return options open.” This is the category where most fashion/luxury brands – such as Chanel, Gucci and Balenciaga-owner Kering, Louis Vuitton and Dior parent LVMH, Hermès, Prada, Moncler, Rolex, Ferragamo, Canada Goose, ACNE, Ganni, and Ralph Lauren, among others – are listed. Fast fashion companies H&M (which is “winding down business entirely”), Boohoo Group, and ASOS are included within this camp, as do retailers like Farfetch and Yoox, and mass-market names like adidas, Crocs, Ugg-owner Deckers, Levi Strauss, Puma, Northface and Supreme owner VF Corp., and Victoria’s Secret, the latter of which has “stopped exports to Russia, paused sales in Russia by franchisers, [and] suspended online sales.”

A Balancing Act

The balance between leaving the Russian market entirely and continuing to operate there/opting to provide goods/services that fall within the threshold allowed by sanctions (Italian fashion companies are permitted to export goods whose wholesale price is under 300 euros to Russia) has proven to be a tricky one from companies. Making a clean break for Russia has obvious benefits from a logistical perspective, along with benefits from a public relations perspective, especially given the increasingly ESG-specific stance that younger pools of Western buyers have taken in recent years; it also enables companies to more easily ensure that they are complying with various sanctions – which have, in many cases, been modified over time – thereby, reducing their potential exposure to criminal and civil penalties.

In the short term, the rush of companies to remove themselves from the Russian market – at least for the time being – “will cost companies,” including fashion brands, “surprisingly little,” Hooper asserts. (For some context, French luxury goods titan LVMH, for instance, has typically generated less than 2 percent of annual revenue from Russia, while Cartier-owner Richemont has derived roughly 3 percent of its annual sales from the country in the past. It is worth noting that such impacts are not limited to sales that occur in Russia, as no shortage of deep-pocketed Russian consumers already do their luxury shopping outside of the country in markets like London and Dubai, along with Milan and Paris.)

Not without drawbacks, attempts by companies to walk away from their operations in Russia have likely proven complicated and costly. Beyond that, such moves could put them at risk of facing legal consequences, including lawsuits waged by consumers and companies, alike. As of April, at least two class action lawsuits had been filed against Western companies in the wake of their moves to halt operations in Russia. Moscow-based firm Chernyshov, Lukoyanov & Partners filed suit on behalf of pools of Russian consumers against Apple and Netflix, accusing the two companies of running afoul of consumer rights laws. (Apple has “suspend[ed] all official site sales; turn[ed] off select apps and services,” per CELI, getting it a “B” rating, while it found that Netflix – which has an “A” rating – has “suspend[ed] service in Russia.”)

In connection with the lawsuits, as first reported by Reuters, the plaintiffs are seeking 60 million rubles ($998,750) in moral damages from Netflix users and 90 million rubles ($1.5 million) from Apple for reducing its devices’ functionality and value. Those figures are likely to increase as more individuals join the pool of plaintiffs, per Reuters.

At the same time, Moscow-based company Talmer reportedly filed suit against Dell (which CELI says has “suspend[ed] all shipments to Russia”) for allegedly cutting off technical support for VMWare cloud computing services.