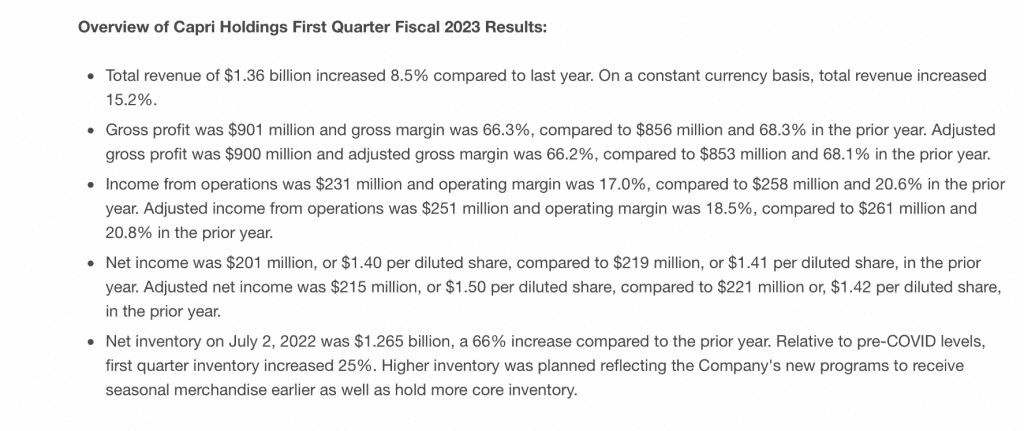

Capri Holdings reported on Tuesday that its revenue reached $1.36 billion for the first quarter, up 8.5 percent compared to the same three-month period last year. The Versace, Michael Kors, and Jimmy Choo owner touted “better than anticipated results across all three luxury houses” for the quarter ending on July 2, with Michael Kors generating $913 million of the group’s sales (up 4.8 percent year-over-year), Versace accounting for $275 million of the group’s sales (up 14.6 percent YoY), and Jimmy Choo bringing in $172 million in revenue (up 21.1 percent). Looking ahead, Capri anticipates that its brands will generate revenue of $5.85 billion – and an operating margin of roughly 18 percent – for the full year.

Delving into group revenue trends by geography, Capri reported that growth in the Americas “continued to exceed expectations,” increasing 11 percent on a reported basis to $794 million, followed by EMEA with $364 million in sales (up 21 percent), which was “driven by strong growth across all houses benefiting from robust domestic consumer demand, as well as an increase in pan-European travel.” Sales in Asia were down for each of the Capri brands, totaling $202 million in sales for the quarter (a 14 percent drop year-over-year), reflecting a mid-30 percent decline in sales in Mainland China.

In a call with analysts on Tuesday, Capri chairman and CEO John Idol stated that the year is off to “a better-than-anticipated start,” noting that the group’s brands “continue to resonate with consumers, as evidenced by the 12 million new names added across our databases over the last year.” Among a couple of the interesting takeaways from the call came on the pricing and resale fronts, with Idol asserting that (in line with a larger industry-wide trend to raise prices) management has implemented price increases for Michael Kors offerings “for over 2 years” and more will be coming “this fall and some in the spring season.”

At the same time, Idol noted that Jimmy Choo “started its price increases a little over a year ago,” and Versace – which he says is “probably on the lower end of some of the pricing in particular, in accessories versus our luxury competitors” – is putting price hikes in place “as we speak.”

Idol confirmed that the group has “not seen any consumer resistance to those increases.” As for why consumers are seemingly unfazed by the the Capri brands’ boosted prices: In addition to “the strength of our designs” and enduring demand for accessories, Idol referenced the robust resale market as helping to drive more expensively-priced offerings.

“Interestingly enough, the resale market has, I think, created a comfort level with people in the luxury world that they can not only purchase and enjoy, but they can – they see value in the ability to be able to resell product,” Idol said on the call. “I think we all might have been concerned about it a few years back, but it’s actually created a circular economy and one that we think actually helps people, especially those who want fashion,” he further stated, noting that consumers “want it new, they want it early, and they might not have as much space to either keep these things in their home or they just want to update their wardrobes on a more regular basis, and this is a nice way to keep circulating the product.”

Another point worth taking away comes by way of inventory, as Capri revealed that it ended the quarter with $1.265 billion in inventory, a 66 percent increase over “a historically low level [of inventory] last year” when the group did “did not have enough inventory to meet consumer demand.” Relative to pre-COVID levels, Capri chief financial and operating officer Thomas Edwards told analysts on Tuesday that “first quarter inventory increased 25 percent,” but said that “as a reminder, we anticipated elevated inventory levels as we implemented new programs to receive seasonal merchandise earlier as well as hold more core inventory given supply chain delays.” Edwards claims that the group expects that inventory levels “will moderate sequentially [for the remainder of the year] and as planned, be below prior year by the end of the fiscal year.”

Finally, touching upon consumer demand, Idol revealed that, “in luxury, it is both accessories and footwear that we think are driving consumer desire, [and] consumer engagement,” with footwear being “a big part of our growth strategy.” Idol also cited its individual houses’ codes as resonating with consumers and “creat[ing] a further sense of brand loyalty.” Idol pointed to Versace, in particular, where he said that all product categories “performed well as we continued to reinforce and amplify Versace’s iconic brand codes.” Specifically, he stated that thanks to the brand’s “three pillars” – Medusa, La Greca and Virtus, the company is “gaining traction in accessories,” a category that is growing “much faster than anticipated,” thereby, adding to the groups’ confidence in its ability to position Versace as “a leading luxury leather house and expand accessories revenues to $1 billion over time.”