Companies’ trademark rights and their ability to control the distribution of their coveted offerings could be threatened in the midst of the escalating sanctions being levied upon Russia and boycotts from brands that have temporarily shuttered operations. In the wake of its attack on Ukraine and the fall-out that is coming in the form of supply, the Russian government is considering the possibility of “lifting restrictions on the use of intellectual property [for] certain goods that are limited in Russia.” Specifically, media outlets in Russia have reported that the Ministry of Economic Development may opt to do away with civil liability for trademark infringement in connection with goods that are in short supply due to sanctions or as a result of companies closing up shop for the time being.

The proposed trademark-centric actions by the Russian government would undoubtedly have an effect on brands across industries, as even though existing sanctions do not directly block a wide range of companies or stand in the way of the export of an array of goods to the Putin-led nation, companies are, nonetheless, being affected. With shipping giants, such as UPS and FedEx, pausing their services both to and from Russia, companies that are legally permitted to export to Russia are facing off against logistics/supply disruptions. Beyond that, the striking plummet in the value of the ruble has made it so that luxury goods brands, whose goods are currently shielded from sanctions, have little desire to continue to sell their products in exchange for the significantly-diminished Russian currency.

Meanwhile, mass market brands like Nike and H&M have closed up their brick-and-mortar stores in Russia and their e-commerce offerings, and Western companies like McDonald’s and Starbucks have brought their operations to swift halt.

Against this background, and given the notably low supply in stores that do remain open, such as Russian department stores, following a recent bout of “panic buying” by consumers looking to trade in their rubles for hold-value luxury goods and/or to get their hands on luxury goods before brands inevitably shut the coffers amid sweeping pressure to cease business as usual, there is a chance that brands will face off against a greater amount of counterfeiting or infringement than usual – and that the spike will go unchecked by Russian authorities. (The market for counterfeits in Russia is currently estimated to amount to $50 billion in sales per year.)

“Russian courts are unlikely to provide assistance” in the event of trademark infringement actions from non-native rights-holders, and “Russia will simply ignore any international legal action,” World Trademark Review reported this week. More broadly, this could have a “significant impact on the ability of brands to recover their market presence, should they look to re-enter the Russian market in the future,” WTR states. Given that brands “are already losing that revenue by suspending their commercial activity in Russia, without robust intellectual property rights, Western brands will find it harder to go back into Russia should things change in the future.”

A Rise in the Grey Market

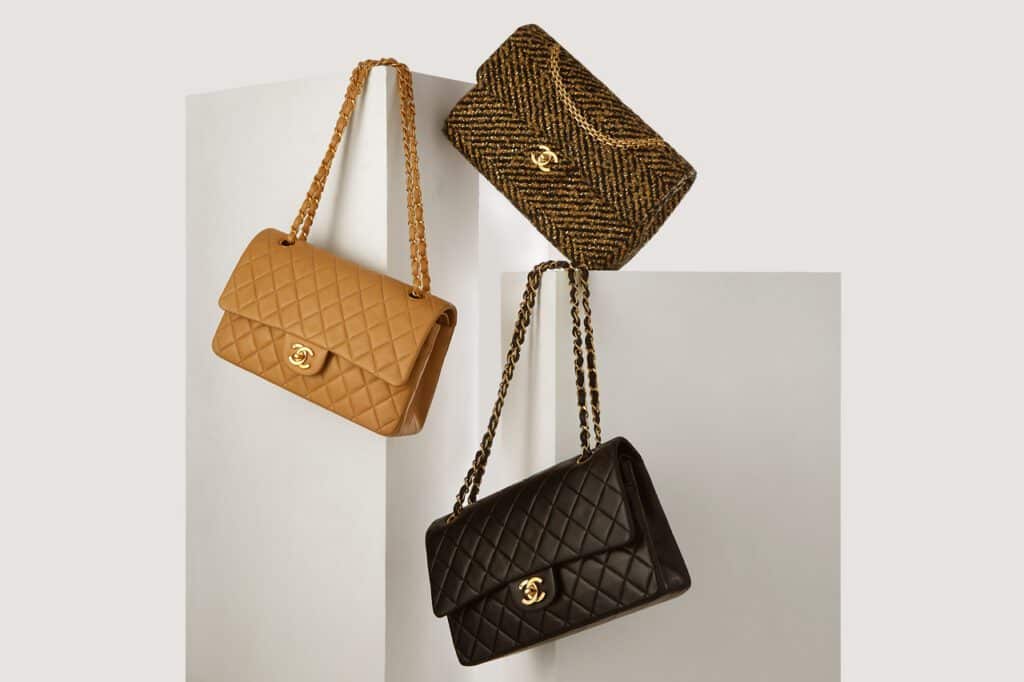

Aside from a potential spike in the availability of illicit goods and services – from fake designer handbags to branded sneakers (and maybe even the unauthorized operations of makeshift “Starbucks” outposts), the language of the recently-released “Priority Action Plan for Ensuring the Development of the Russian Economy in the Conditions of External Sanctions Pressure” suggests that another outcome could be an influx of grey market goods. In the Priority Action Plan, which surfaced this week, the Russian Ministry of Economic Development seems to propose suspending liability for parties engaging in parallel imports for certain (not yet defined) “groups of goods,” thereby, potentially opening the door for a greater share of out-of-channel products to flow into Russia, which maintains some restrictions on the sale of grey market goods.

Depending on how long the side-effects of Russian sanctions last, including the bottomed-out ruble and significant shipping/supply quagmires (and chances are this is not a temporary situation), the luxury goods ecosystem in Russia may begin to mirror that of China, which routinely sees a significant supply of grey market goods coming by way of multi-brand stores in places like Italy and landing on the mainland after passing through agents in Hong Kong. In the event that their self-operated stores do not return in a timely manner, luxury brands may opt to look the other way, enabling multi-brand stores in other markets to order excess goods and ship them to Moscow with the help of parallel importers. (These products would likely be routed through another country, such as Turkey or Uzbekistan, and then to Russia.)

And while this approach would enable brands to boost their revenues thanks to larger orders to multi-brand stores, putting it in the realm of the traditional grey market model, it also would potentially provide them with the opportunity to uphold a formal position of distancing themselves from Russia and claim ignorance in the event of consumer pushback. Even still, the likelihood that luxury brands will begin feeding the grey market in Russia seems relatively small – at least as of now – in light of the minuscule size of the Russian market for luxury goods (luxury brands generate roughly 2.5 to 3 percent of annual revenues from the country, according to Jefferies data) and the very real risk of serious reputational damage for brands should such a set up make headlines.

Given the higher stakes for mass market apparel and footwear companies, which generate considerably more revenue from Russia on an annual basis than luxury players, the draw of grey market sales may be much greater.

It is currently unclear whether the trademark aspects of the proposed directive will come in to play. However, it is worth noting that the Kremlin has taken action on the patent front, “effectively legalizing patent [infringement] from anyone affiliated with countries ‘unfriendly’ to it,” the Washington Post reported on Thursday, with the Russian government “declaring that unauthorized use will not be compensated.”

At the same time and in accordance with guidance from the U.S. Department of State, the U.S. Patent and Trademark Office recently terminated engagement with officials from Russia’s agency in charge of intellectual property, the Federal Service for Intellectual Property, and with the Eurasian Patent Organization. The USPTO revealed that it has also terminated engagement with officials from the national intellectual property office of Belarus, noting that “like so many, we are deeply saddened by the events unfolding in Ukraine.”