The rising interest in web3 – and various facets of it, from cryptocurrencies to non-fungible tokens (“NFTs”) – that has come about in recent years has brought with it no shortage of lawsuits, as companies and creators look to navigate the volatile market for digital tokens, and in many of the most interesting cases to date, the intellectual property issues that have come hand-in-hand with the use of these relatively novel technologies. A growing number of lawsuits over NFTs, in particular – including the case that Nike filed against StockX over its use of Nike trademarks on NFTs tied to hot-selling sneakers and Hermès’ trademark battle against artist Mason Rothschild – are raising novel legal questions, while also parlaying some of brands’ biggest “real world” issues into the virtual world.

At the same time, these cases – which are not limited to NFTs and extend to those that center on failed crypto exchanges, such as FTX, for example – stand to provide some guidance for companies, as more and more brands look for ways to adapt their existing models for an increasingly web3-focused world.

The following is a running list of some of the most noteworthy lawsuits over web3 that have been filed in the United States …

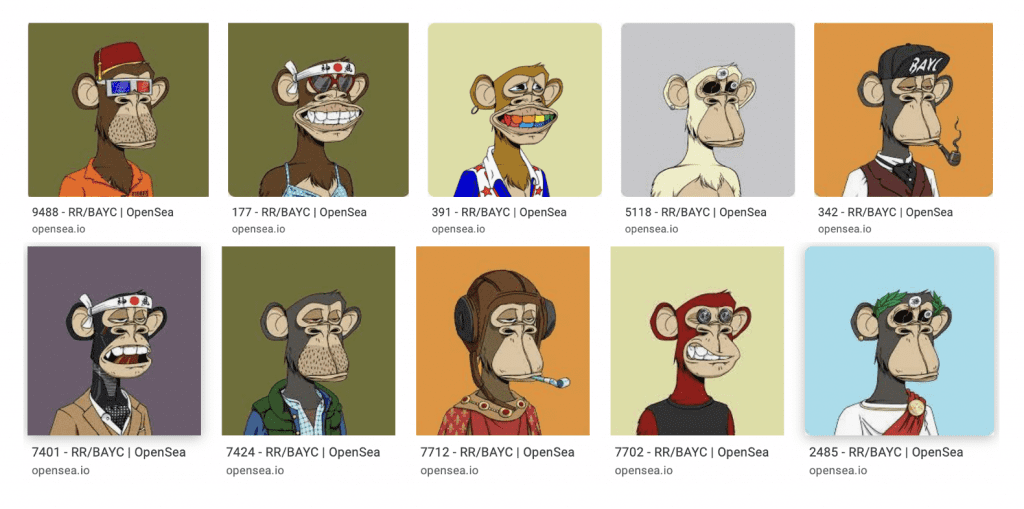

The company behind the popular collections of Bored Ape Yacht Club (“BAYC”) tokens is suing a group of defendants, including Ryder Ripps in a headline-making trademark case, accusing the artist and other defendants of “trolling Yuga Labs and scamming consumers into purchasing RR/BAYC NFTs by misusing Yuga Labs’ trademarks.” In the complaint that it filed in a California federal court on June 24, Yuga Labs claims that Ripps, Jeremy Cahen, and a number of other affiliated defendants are on the hook for trademark infringement, false designation of origin, cybersquatting, and conversion for creating and selling NFTs that bear “the very same trademarks that Yuga Labs uses to promote and sell authentic BAYC NFTs.”

In furtherance of his alleged quest to “devalue the Bored Ape NFTs by flooding the NFT market with his own copycat NFT collection using the original Bored Ape Yacht Club images and calling his NFTs ‘RR/BAYC’ NFTs,” Yuga Labs alleges that Ripps has reaped “millions of ill-gotten profits from these sales” (an estimated $5 million), all while simultaneously using its trademarks to promote “the imminent launch of an entire NFT marketplace called ‘Ape Market’ solely to sell the RR/BAYC NFTs alongside authentic Yuga Labs NFTs.”

Yuga sets out claims of common law trademark infringement (as its long list of BAYC-centric trademark applications are still pending before the U.S. Patent and Trademark Office), false designation of origin and false advertising under the Lanham Act, cybersquatting, conversion, unjust enrichment, violations of California Business and Professions Code, intentional interference with prospective economic advantage, and negligent interference with prospective economic advantage. (Note: Yuga does not appear to have any copyright registrations for its ape images and does not claim copyright infringement in its complaint.)

UPDATED (Oct. 25, 2023): In a Findings of Fact and Conclusions of Law, the court awarded Yuga Labs $1.38 million of the defendants’ profits from the sale of the RR/BAYC NFTs, $200,000 in statutory damages, and attorneys’ fees and costs in an amount that ha snot yet been determined. Beyond those remedies, the court issued a permanent injunction, which requires Ripps and co. to transfer several domain names and Twitter handles (including rrbayc.com) and to relinquish control of the RR/BAYC NFTs smart contract.

In another case involving BAYC NFTs, Yuga Labs, Hollywood agent Guy Oseary, and a number of big-name celebrities and brands – from adidas and Universal to Justin Bieber, Madonna, Gwyneth Paltrow, and Serena Williams – are among a long list of defendants that are allegedly on the hook for perpetuating a scheme to promote the NFTs, while allegedly running afoul of federal and state laws.

Nike filed suit against StockX early this year, alleging the Detroit-based marketplace is on the hook for trademark infringement and dilution, as well as unfair competition, in connection with its offering up of NFTs tied to images and physical versions of Nike footwear – albeit without receiving its authorization. To make matters worse, Nike claims that StockX is “selling those NFTs at heavily inflated prices to unsuspecting consumers who believe or are likely to believe that those ‘investible digital assets’ (as StockX calls them) are, in fact, authorized by Nike.”

Nike amended its complaint in May to add counterfeiting and false advertising claims.

StockX has since responded to Nike’s complaint, denying the bulk of the claims that Nike has lodged against it and asserting that they “lack merit, disregard settled doctrines of trademark law … and show a fundamental misunderstanding of the various functions NFTs can serve.” At the core of StockX’s defense is its claim that the NFTs at issue are little more than “claim tickets” or “digital receipts” used to “track ownership of a specific physical Nike product that StockX has purportedly authenticated using its ‘proprietary, multi-step authentication process’” – putting the sale of the sneakers (and corresponding NFTs) firmly within the realm of the First Sale Doctrine.

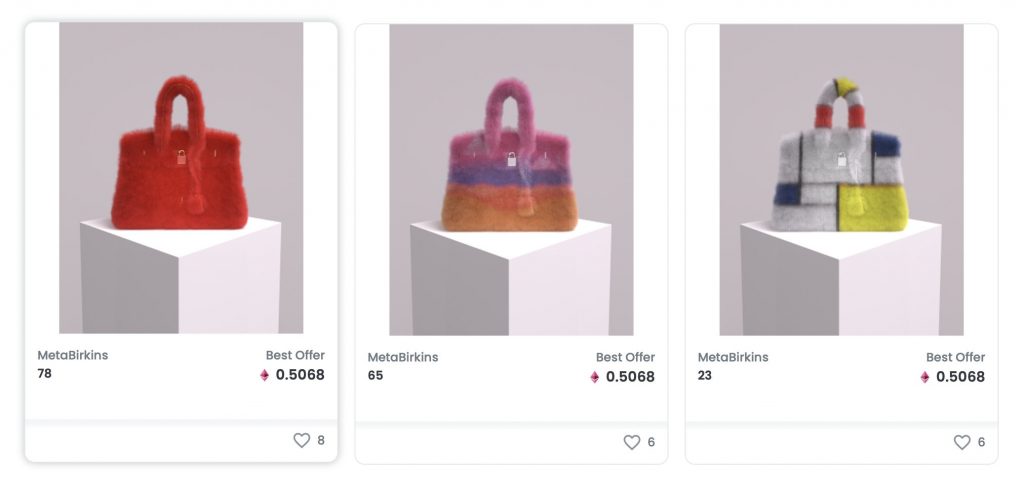

In January, Hermès filed a trademark infringement, federal trademark dilution, false designations of origin, false descriptions and representations, cybersquatting, injury to business reputation, misappropriation, and unfair competition lawsuit against Mason Rothschild, the individual behind the collection of 100 MetaBirkins NFTs. Tied to images depicting furry renderings of its famous Birkin Bag, Hermès claims that in furtherance of his sale of the NFTs, Rothschild simply “rip[s] off Hermès’ famous BIRKIN trademark by adding the generic prefix ‘meta,’” which refers to “virtual worlds and economies where digital assets such as NFTs can be sold and traded.”

Rothschild recently pushed for a dismissal of Hermès’ lawsuit on the basis that his “fanciful depictions of fur-covered Birkin bags and his identification of his artworks as ‘MetaBirkins’ are artistically relevant and do not explicitly mislead about their source or content,” and thus, are protected as artistic expression under the First Amendment. Unsuccessful, Judge Jed Rakoff of the U.S. District Court for the Southern District of New York sided with Hermès, holding that while there may be an “artistic aspect” to the images tied to the MetaBirkins NFTs (making the Rogers test applicable), Hermès has, nonetheless, sufficiently set out allegations that Rothschild’s use of “MetaBirkins” was not artistically relevant or was explicitly misleading.

A rep for Rothschild told TFL on July 27, “The judge ruled that MetaBirkins are artistic speech protected by the First Amendment. There are two remaining questions that the judge said need to be addressed. First, is the title “MetaBirkins” artistically relevant to the artwork? In our view the answer is clearly yes—the artworks are illustrations of imaginary fur-covered Birkin bags, and the title MetaBirkins describes what the artworks are about. The second question is whether I’ve made any explicit claim that Hermes is responsible for the MetaBirkins artwork, and again we look forward to showing that I’ve always identified myself as the creator, not Hermes.”

UPDATED (Feb. 8, 2023): The jury sided with Hermès in its fight over digital artworks that mirror the design of its famed Birkin bag – and that bear the name “MetaBirkins” – and that are tied to non-fungible tokens that were first offered up in December 2021. Finding that MetaBirkins creator Mason Rothschild is liable on all three counts, trademark infringement and dilution, and cybersquatting, and that he is not shielded by First Amendment protections, the jury returned their verdict on Wednesday morning (early into the third day of deliberations), awarding Hermès roughly $133,000 in damages.

Nearly a dozen big-name celebrities have landed on the receiving end of since-consolidated class action complaints lodged with the U.S. District Court for the Southern District of Fla. for allegedly engaging in deceptive and unfair trade practices and civil conspiracy. In addition to naming FTX founder and former CEO Sam Bankman-Fried as a defendant in the case, the plaitniffs claim that Tom Brady, Gisele Bundchen, Stephen Curry, Shaquille O’Neal, Udonis Haslem, David Ortiz, William Trevor Lawrence, Shohei Ohtani, Naomi Osaka, Lawrence Gene David, and Kevin O’Leary, as well as the Golden State Warriors, are on the hook for having “promoted, assisted in,” or “actively participat[ing] in” the offer and sale of unregistered securities by way of failed crypto exchange, FTX.

In a non-IP case, Jeeun Friel filed suit against Dapper Labs, Inc., on behalf of a purported class of similarly situated individuals, arguing that Dapper Labs and its founder and CEO Roham Gharegozlou sold NFTs called “NBA Top Shot Moments” in violation of federal securities laws, as the NFTs amount to unregistered securities. Specifically, Friel asserts that the Top Shot NFTs amount to securities because they “constitute an investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others,” a nod to the test in SEC v. Howey, which established what qualifies as an “investment contract” and thus, is subject to U.S. securities laws.

Dapper Labs has pushed back against Friel’s claims, arguing that he has failed to establish that the NFTs meet the Howey test because the NFT buyers do not share either horizonal nor vertical commonality, and the NFTs at issue do not come with a reasonable expectation of profits, as they are “objects of play and not for investment or speculative purposes.”

(Given that the NBA Top Shots NFTs are hosted on a blockchain that is exclusive to Dapper Labs and can only be bought, sold, and traded on that blockchain, which is distinct from how the bulk of other NFTs work, this likely means that any decisions in this lawsuits (or other lawsuits like it) when it comes to the issue of whether the NFTs are securities could have relatively limited precedential value.)

In November 2021, Miramax filed suit against Quentin Tarantino, seeking to enjoin the Pulp Fiction director from auctioning off “exclusive” memorabilia associated with the film in the form of “secret” NFTs. In its complaint, Miramax alleges claims of copyright infringement, trademark infringement, and unfair competition. In addition to arguing that Tarantino is likely to confuse consumers about the source of the Pulp Fiction-linked NFTs, Miramax alleges that Tarantino is on the hook for breach of contract, as his “narrowly-drafted” Reserved Rights (as distinct from Miramax’s “broad, catch-all rights,” which include “all rights . . . now or hereafter known. . . in all media now or hereafter known”) do not extend to his offering up of used excerpts of the screenplay as NFTs.

Counsel for Tarantino has pushed back, asserting, “Miramax is wrong — plain and simple. Quentin Tarantino’s contract is clear: he has the right to sell NFTs of his hand-written script for Pulp Fiction and this ham-fisted attempt to prevent him from doing so will fail.”

UPDATED (Sept. 8, 2022): In a notice of settlement filed on Sept. 8, the parties alerted the court that they “have settled this case and expect to file their dismissal papers within two weeks.”

Roc-A-Fella named Damon Dash in a copyright case (one of the first copyright lawsuits involving NFTs) in a bid to stop him from auctioning off the copyright to Jay-Z’s debut album “Reasonable Doubt” as an NFT. In its complaint, Roc-A-Fella Records, Inc. (“RAF, Inc.”) – which Jay Z founded with Damon Dash and Kareem Burke in 1995 – alleged that Dash was planning to auction off the copyright rights to the famed album as an NFT despite not owning the copyright. Setting out claims of breach of fiduciary duty, conversion, replevin, and unjust enrichment, the record label argued that Dash does not own the copyright (RAF does), and as a shareholder in RAF, Dash is entitled to part of its profits, indirectly giving him some of the royalty income from Reasonable Doubt.

UPDATED (Jun. 27, 2022): In a final order in the wake of the parties submitting joint stipulations stemming from a settlement, the court signed off on an judgment that states, “As between the Parties, RAF, Inc. owns all rights to the album Reasonable Doubt, including its copyright, and this Judgment shall prohibit the altering in any way, sale, assignment, pledging, encumbering, contracting with regard to, or in any way disposing of RAF, Inc.’s property interest in Reasonable Doubt, including its copyright, and including through any means such as auctioning a non-fungible token reflecting, referring, or directing to such interest, unless duly authorized by RAF, Inc.; provided, however, that nothing in this Judgment shall prevent Dash from selling, assigning, pledging, encumbering, contracting with regard to, or in any way disposing of his one-third (1/3rd) ownership interest in RAF, Inc.”

As part of the settlement, “All claims and causes of action asserted in this case brought by RAF, Inc. against Dash are hereby dismissed without prejudice and all claims brought by Dash against RAF, Inc. are hereby dismissed without prejudice, with the Parties’ to bear their respective costs, including any possible attorneys’ fees and other expenses of this litigation.”

Tamarind Art filed a breach of contract and declaratory judgment lawsuit, accusing the administrators of Maqbool Fida Husain’s estate (“MFH Estate”) of standing in the way of its launch of a series of NFTs related to Husian’s “Lightning” painting that Tamarind acquired in 2002. Despite holding “the exclusive, worldwide, royalty-free license to reproduce [the artwork] in any format, including digital formats,” Tamarind claims that it received a cease-and-desist letter from the MFH Estate, accusing it of copyright infringement, and demanding that it immediately halt its plans to release NFTs and its corresponding marketing campaign.

UPDATED (Feb. 8, 2023): The Court has been advised that all claims asserted herein have been settled in principle. The Clerk of Court is directed to close the case.

An aggrieved NFT buyer filed suit against cryptoartist Matt Furie for allegedly misrepresenting the number of NFTs that would ultimately be offered up in furtherance of a “scheme to artificially inflate the value” of his FEELSGOOODMAN Rare Pepe Card NFT. In the complaint, Halston Thayer alleges that Furie and the other defendants, including a decentralized autonomous organization set up in order to “feature and sell Furie’s cryptoarto,”duped him into “grossly overbidding” for the digital token he acquired for a cool $507,084 last fall by falsely advertised that only one of Furie’s Pepe NFTs would be made available. Thayer set out claims of fraudulent inducement, intentional misrepresentation, negligent misrepresentation, violation of unfair competition law, violation of the Consumer Legal Remedies Act, mistake of fact, breach of contract, breach of good faith and fair dealing, unjust enrichment.

UPDATED (Aug. 22, 2022): The parties filed a joint notice of motion and motion to dismiss case with prejudice.

This article was initially published on July 1, 2021 and has been updated to reflect developments in the cases/new case filings.