Every day, an increasing number of consumers are joining the second-hand fashion movement. From typical brick-and-mortar thrift stores to sophisticated pre-loved shops on the high street and online resale marketplaces, consumers love to go second-hand “hunting” in search for unique pieces that are affordable and sustainable. According to Bain & Company, 45 billion euros ($49.3 billion) worth of secondhand luxury products were sold worldwide in 2023. Meanwhile, Boston Consulting Group estimates that the value of the secondary market for fashion and luxury goods amounts to 3 percent to 5 percent of the general fashion sales and is expected to grow by up to 40 percent in the coming years.

What does this mean for the intellectual property world, and in particular, the exhaustion of trademark rights, parallel imported goods, the repackaging and upcycling of second-hand goods and, of course, the sale of counterfeit goods in the secondary market? An exploration of these issues from a European Union perspective is warranted in order to provide some guidance for brand owners.

Exhaustion of Rights

The first question at play here is whether trademark rights in second-hand fashion items have been exhausted. The answer is not simple. Article 15.1 of the EU’s Trade Mark Directive states that trademark rights are exhausted if the goods bearing the trademark have been put into the market in the European Economic Area (“EEA”) by trademark owners or with their consent. However, how can trademark owners know for sure where second-hand products were initially put on the market? Many of the products that are being offered up in a resale capacity were produced many years ago, and their traceability is almost impossible. In addition, even if trademark owners know the country in which the products were first authorized for sale and it is not in the EEA, a question worth asking here is whether it would be above-board from a sustainability standpoint for companies to object to their resale just because they are grey market goods?

The second question is whether any of the exceptions to trademark exhaustion apply. Under Article 15.2 of the Trade Mark Directive, for example, significant damage to a trademark’s reputation is a valid reason for trademark owners to oppose further commercialization of the goods. In Christian Dior v. Evora, C-337/95 (ECLI:EU:C:1997:517), the Court of Justice of the European Union (“CJEU”) held that Article 15.2 applies – particularly for luxury brands – as long as a brand owner can prove that its aura of luxury has been severely damaged by how a reseller advertises the goods.

Some thrift store clothes can be hung carelessly and offered up in bulk. At the same time, such products are generally advertised with big discount signs or via cheap materials – as distinct from the marketing materials and the sales conditions observed in luxury brands’ authorized retail stores. One could argue that subpar sales tactics and marketing efforts take away the aura of luxury and distort a brand’s reputation. On the other hand, suppose that the advertising methods used by a reseller company can be seen as a common one in the second-hand industry, and that there is no substantial evidence of serious damage to the underlying brand’s reputation. In that case, a brand owner is unlikely to stop the sale of second-hand goods – no matter how undesirable they might be for the brand.

Moreover, in BMW v. Deenik, C-63/97 (ECLI:EU:C:1999:82), the CJEU held that trademark owners can object to the use of their marks by third parties if it creates the impression of a commercial affiliation/association between them and those third parties. Against that background, second-hand sellers should keep their use of others’ marks to a minimum – only to identify the source of the products. They also need to clearly alert consumers that they sell second-hand pieces and that their retail stores and/or websites have no affiliation with the brands they offer.

De-Branding & Repackaging

De-branding occurs when a trademark is removed from a product (and usually replaced with another party’s trademark), or a parallel importer (i.e., a party that obtains genuine branded goods from one market and subsequently imports them and offers them for sale in another market without the consent of the owner of the trademark) does not affix the trademark to the new package in the event that a product is repackaged. Brand owners can use de-branding arguments against upcycling, especially when it comes to trademarks and products of high reputation. As the CJEU held in Portakabin. v. Primakabin, C-558/08 (ECLI:EU:C:2010:416), in the event of de-branding, trademark owners can prevent a reseller from using their trademark to advertise that resale. Meanwhile, in Boehringer Ingelheim v. Swingward, C-348/04 (ECLI:EU:C:2007:249), the court stated that if a parallel importer fails to affix the original trademark to the new exterior package (i.e., engages in de-branding), that party is, in principle, liable to damage the trademark’s reputation, which is a question of fact for the national courts to decide on a case-by-case basis. Even still, parties engaging in upcycling can counter-claim that upcycling boosts a brand’s reputation and is a solution to the unsustainable current fashion model.

On the other hand, second-hand sales may also involve repackaging. As the CJEU held in BMS v. Paranovam C-427/93, C-429/93 and C-436/93 (ECLI:EU:C:1996:282), this could be legitimate, provided that some standards are being met inter alia, the repackaging does not adversely affect the quality of the goods, there is enough information on the new packaging to identify the reseller, and the new packaging is of a quality that respects the underlying brand’s reputation.

Counterfeit Goods

Last but not least, a hot topic for second-hand fashion is the resale of counterfeit goods. Many products in the secondary market were usually years (and even decades) ago, and it is often difficult to identify whether they are counterfeit or authentic products. In fact, brands may lack the product knowledge to do so, while low prices can no longer serve as a counterfeit indicator, as second-hand goods are usually cheaper; thus, it can be easy to miss them. Counterfeiters might also use second-hand sales to disguise their fakes as more affordable second-hand goods.

A Snapshot of the Secondary Market

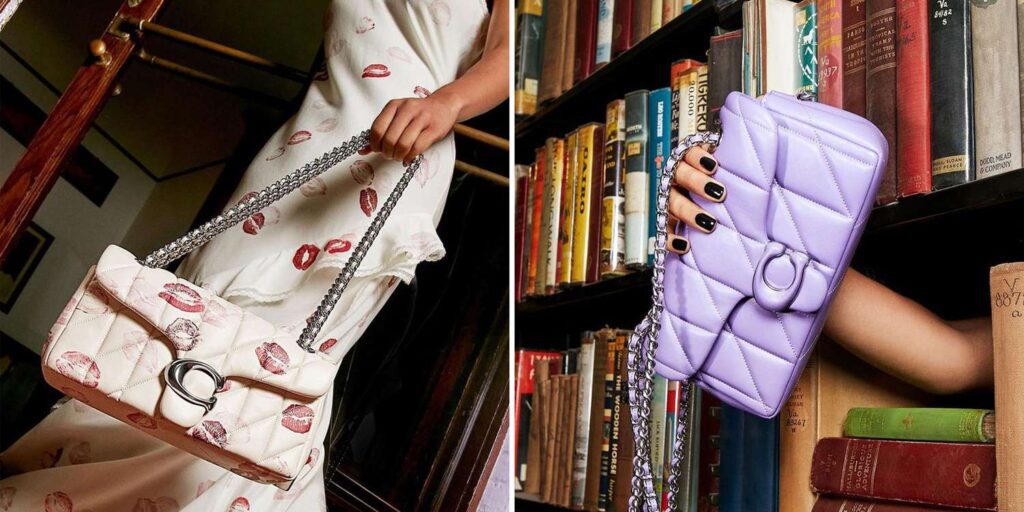

EU law appears to give brand owners space to act against second-hand sales. Nevertheless, as the size and value of the second-hand fashion market continues to grow, brand owners must understand the need to embrace it rather than object to it. After all, second-hand might be the answer to – or at least a big step towards – making fashion more sustainable. This is part of why many brands have started entering the second-hand market, creating web shops to sell vintage items or allow consumers to list their pre-owned items. Brands looking to engage in the segment of the market could also create pop-up or permanent establishments to sell pre-owned goods, which could enable them to exert greater control over the quality of the second-hand goods at issue and also preserve any aura of luxury. Moreover, it could give brands part of the second-hand turnover they would miss otherwise.

Beyond that, brands could attract new audiences and stay relevant by way of resale endeavors of their own, showing that they keep evolving to meet the needs of their audience. And still yet, brands could use the data of second-hand buyers to find new target audiences.

In addition to operating resale ventures in house, brands could partner with second-hand retailers and online platforms like Vestiaire, Depop, and Vinted, which could be beneficial for brand owners and online platforms, alike. Online platforms can be tasked with handling all of the technical aspects of the transactions, including shipping, logistics and authentication, while gaining credibility, amassing greater brand awareness, and building up their customer base by partnering with brand owners. Meanwhile, brands could benefit from the online platforms’ logistic systems without investing in their own.

Finally, it is essential for brand owners and online platforms to work together to fight counterfeit products. Transparency and intensive training from brand owners are critical to spotting and stopping fakes quickly. Additionally, online platforms should have strict regulations for counterfeit sellers. Product authentication processes and penalties for counterfeit resellers could be used to contain the situation. Blockchain could provide a solution to eliminating fakes by tracking authentic products. All in all, the second-hand movement seems to be a strong one. Of course, only time will tell how it is going to evolve. Fashion brands should certainly explore this new trend and learn how to thrive through it.

Theodora Goula is IP Legal Counsel HUGO BOSS. (This article was initially published by IPKat.)