The number of trademark applications for registration that were filed in key jurisdictions in 2023 indicated a return to a pre-Covid-19 stable growth trend model, according to a new report. Delving into data from six of the key trademark registers from around the world (the United States, European Union, United Kingdom, Mainland China, Japan, and South Korea), Clarivate found that trademark filing activity worldwide saw a return to stability and growth in 2023 after three years of market volatility and is likely on track for “solid growth” in 2024.

In addition to noting the sheer volume of filings lodged with trademark offices in the aforementioned countries, Clarivate shed light on some notable trends in terms of the leading filing parties (and their origins) and industries, the most heavily cited classes of goods/services, and opposition, appeals and litigation activities with regard to trademarks across the globe.

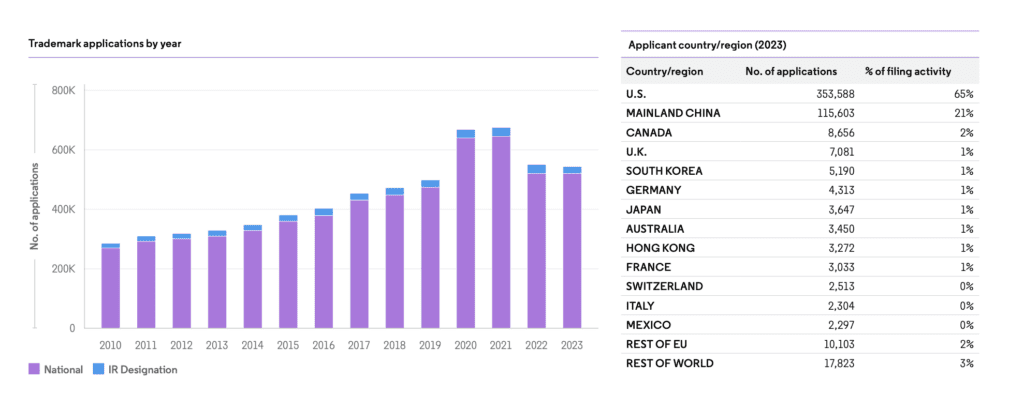

Looking at data from the U.S., Clarivate reported that just over 500,000 new applications were lodged with the U.S. Patent and Trademark Office (“USPTO”) in 2023. The is roughly the same level of filings as the USPTO saw in 2022 but behind the “record years” of 2020 and 2021, which saw “unusually high levels of trademark filing activity,” the data intelligence provider stated. (The spike in filings in 2020 and 2021 occurred, in large part, as businesses “pivoted from brick-and-mortar retail to online platforms in response to the global disruption caused by Covid-19.”)

>> Key classes of goods/services in applications filed with the USPTO in 2023 were: Class 9 (technology), Class 35 (retail and business services), Class 41 (entertainment, sports, education) and Class 25 (clothing and fashion), each of which were cited in over 60,000 applications last year.

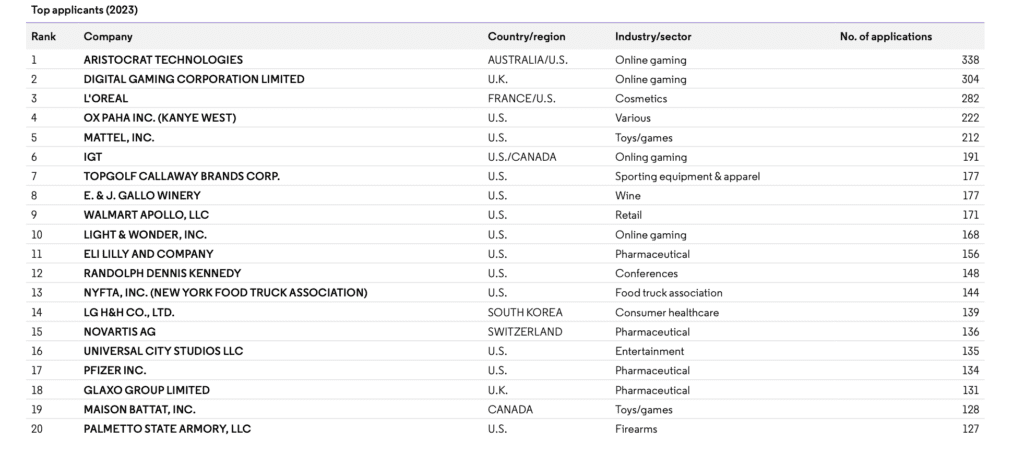

>> The pharmaceuticals and online gaming sectors were the “clear leaders among applicants at the USPTO in 2023” in terms of filing parties’ industries of anticavity, with Aristocrat Technologies and Digital Gaming Corporation Limited taking the top two spots. L’OREAL stood out as a top filer in the U.S. and beyond, having filed the third most applications for registration (282) in the U.S. in 2023, and the most applications in the UK (160) and the EU (240), respectively.

Additionally, Clarivate highlighted rapper-slash-designer Ye’s (formerly Kanye West) company Ox Paha, Inc., which was the fourth highest filer at the USPTO in 2023, having filed 222 trademark applications for marks ranging from YEEZY PODS (and YEEZY PDS) and YEWS to DROME and VILLADROME for use across a wide variety of goods and services. Still yet, Mattel, Inc. took the number 5 spot with 212 applications for registration, an array of which coincided with the release of the Barbie movie, including the BARBIE PINK word mark.

In terms of interesting trends … Clarivate found that Mainland China “continues to be a major source of new trademark applications filed in the U.S.,” with applicants from Mainland China filing over 115,000 applications in 2023 (21 percent of total filing activity for the year in the U.S.) compared to domestic U.S. based brand owners, which filed 353,588 applications at the USPTO in 2023 (65 percent of total filing activity).

The especially notable element here is that despite making up such a sizable share of filing parties in 2023 (the most of any foreign nation), Chinese filers were involved in less than 1 percent of all Trademark Trial and Appeal Board proceedings, including oppositions, appeals, etc. “This suggests that applicants from this region have developed a strategy to avoid serious objections” from USPTO examining attorneys, per Clarivate, which asserted that this includes filing for marks that consist of “random letter strings.” One need not look further than the names of Chinese brands on Amazon – where purveyors of China-made goods are doing business under brand names like Pvendor, RIVMOUNT, FRETREE, MAJCF, Nertpow, SHSTFD, Joyoldelf, VBIGER and Bizzliz – to see this phenomenon in action.

Not limited to the U.S., Clarivate stated that “despite filing over 10 percent of all trademark applications [in the EU], applicants from Mainland China were almost completely absent from appeals to the EUIPO Board of Appeal,” which indicates that they “either did not receive absolute grounds objections or did not defend them.”

A note on AI: While Clarivate did not reflect on the impact of AI when it comes to companies’ 2023 filings, AI-related commercial activity is expected to have an impact on trademark filing volume this year. “Applications at the USPTO that include ‘artificial intelligence’ accounted for around 2 percent of applications filed each month and were growing [as of January 2024],” according to Robert Reading, Clarivate’s director of Corporate Strategy Content. That is likely to grow even further.