Is it a big deal that Dolce & Gabbana has announced that it will increase its sizing to include garments that will range up to size 54 in Italy, the approximate equivalent of a stateside size 18? You bet it is. The move by the Milan-based brand to extend its sizing – which went into force with its currently available pre-fall collection – “makes it one of the most inclusive designer brands for women,” according to The Independent’s Olivia Petter, a far cry from most high fashion brands, which Fashionista’s deputy editor Tyler McCall says “stop much closer to a size 10 [or] below that even.”

More than merely aiming to fill a void in sizing, something that much of the fashion industry has routinely overlooked even at a time when consumers have the increased ability to influence brands (thanks, in large part, to the connectivity that comes with social media) and when are being called upon to cater to traditionally underserved consumer groups, Dolce & Gabbana’s size-specific endeavor communicates an additional message, one that speaks to how the controversial brand is aiming to make money.

The boost in its sizing range is “a big step for a luxury brand,” veteran journalist Christina Binkley says. “It proves they’re really about selling clothing, rather than using clothing to sell fragrances and handbags.”

In making an attempt to serve a wider pool of consumers by way of its actual apparel offerings. Dolce & Gabbana is setting itself aside from most of the industry’s well-known luxury brands, which rely heavily on their non-garment offerings. (It is also certainly looking to gain some points from a public relations standpoint, which it so desperately needs).

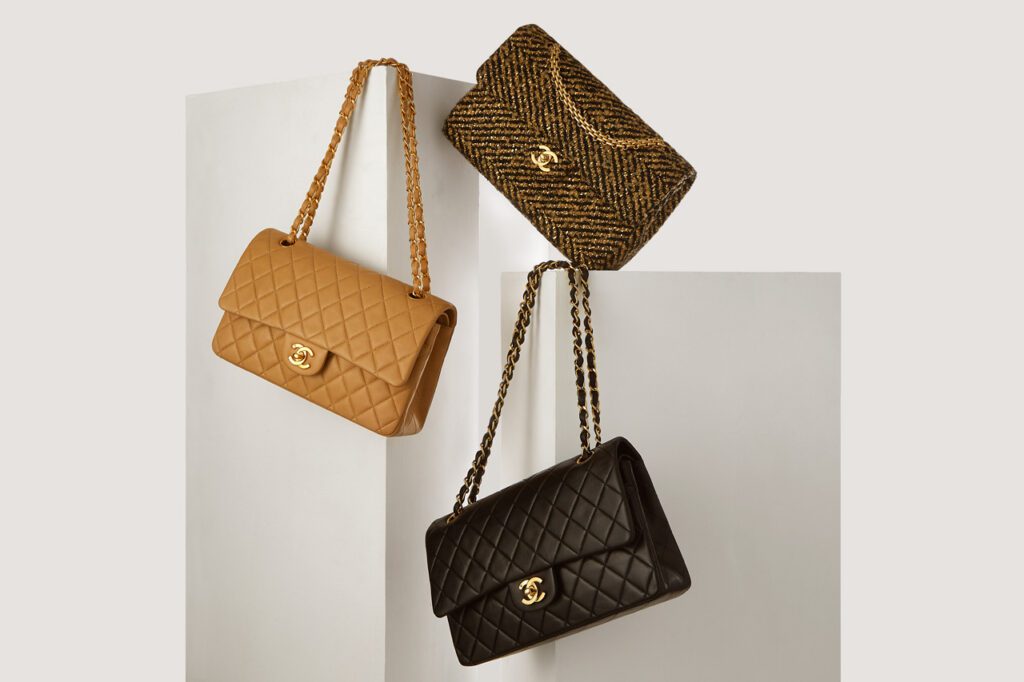

While most big brands tend to stage bi-annual (and maybe even quarterly) runway shows rife with striking garments that are often splashed all over Instagram and depicted in editorials and campaigns, they parlay that runway fashion attention and allure into sales of more commercialized garments (such as knitwear or logo-ed t-shirts), accessories and licensed goods, such as fragrances, eyewear, and jewelry.

It is these high-margin products that represent the bulk of their revenues, with clothing serving a secondary, more marketing-centric purpose.

Look no further than the world’s most valuable luxury brand Louis Vuitton, which, as Bloomberg reported, “knows fashion is a money pit and yet, keeps throwing money in it.” The publication’s Robert Williams and Carol Matlack asserted that “producing collections and staging ever-more glamorous shows tends to wipe out profit for [sales of the brand’s] pricey clothing.” More recently, Jean-Jacques Guiony, the CFO for Louis Vuitton’s parent company LVMH, confirmed that ready-to-wear “is not a major business altogether for Vuitton.”

Instead, he says, it is “obviously a traffic generator for many stores,” which gives the brand the opportunity to sell its sweeping array of more accessible goods, whether that be its relatively recently-introduced fragrances or a coated canvas bag.

An emphasis on ready-to-wear by Dolce & Gabbana – which was “widely reported to have notched up $1.5 billion in revenue in the year to March 2017,” per Reuters, making it one of the largest fashion brands in Italy – is also an interesting one at a time when banking too heavily on apparel has been deemed to be risky. As research and investment consultancy Exane BNP Paribas asserted in a 2017 report, as covered by Quartz, large-scale reliance on ready-to-wear can be a “structural weakness” for luxury brands because while it is a “brand-defining” category, it is “hardly a profitable one.”

That is not to say, however, that the brand has all of its eggs in one basket. While it does not report or break down its revenues as a privately-held company, it has a fair share of entry-level offerings, from iPhone cases and $150 t-shirts to a fragrance portfolio by way of the Tokyo-based Shiseido Group.

In reality, the more pressing question at play is whether the brand will be able to win back its coveted customer base in Asia. Dolce & Gabbana severely fell out of favor after invoking public outrage late last year (which has carried over into 2019) in connection with a controversial ad campaign depicting a Chinese model struggling to eat pizza with chopsticks, and a subsequent race-based scandal involving co-founder Stefano Gabbana.

The incidents have largely gone without much of an apology or rehabilitation campaign by the brand (and in fact, were directly met with threats of litigation), leaving the brand to risk forgoing the market responsible for one third of all luxury purchases in the world, and one that reportedly drives 30 percent of its own annual sales.