Just days after teaming up with Valentino to file a trademark and patent infringement lawsuit against a seller on its marketplace platform, Amazon has announced the establishment of a new Counterfeit Crimes Unit, an initiative that the Seattle-based retail titan says is “dedicated to bringing counterfeiters that violate the law and Amazon’s policies by listing counterfeit products in its store to justice.” Spearheaded by a global, multi-disciplinary team of “former federal prosecutors, experienced investigators, and data analysts,” the new venture aims to “drive counterfeits to zero.”

In a statement released on Wednesday, Amazon revealed that its already-existing objective is to prevent counterfeit products from being listed on its site by third-party sellers in the first place, which is why the $1 trillion company says that it invested over $500 million and had more than 8,000 employees fighting fraud, including counterfeits, in 2019. Piggybacking on those efforts, Amazon says that its Counterfeit Crimes Unit will go a step further and “investigate cases where a bad actor has attempted to evade Amazon’s systems and listed a counterfeit in violation of Amazon’s policies.”

Specifically, “The Counterfeit Crimes Unit will mine Amazon’s data, cull information from external resources, such as payment service providers and open source intelligence, and leverage on-the-ground assets, to connect the dots between targets,” Amazon asserts. More than that, the Counterfeit Crimes Unit will “enable Amazon to more effectively pursue civil litigation against bad actors, work with brands in joint or independent investigations, and aid law enforcement officials worldwide in criminal actions against counterfeiters.”

Speaking about the initiative, Dharmesh Mehta, Amazon’s Vice President of Customer Trust and Partner Support, said on Wednesday, “Every counterfeiter is on notice that they will be held accountable to the maximum extent possible under the law, regardless of where they attempt to sell their counterfeits or where they’re located.” Mehta further asserted that Amazon is “working hard to disrupt and dismantle these criminal networks, and we applaud the law enforcement authorities who are already part of this fight. We urge governments to give these authorities the investigative tools, funding, and resources they need to bring criminal counterfeiters to justice because criminal enforcement – through prosecution and other disruption measures such as freezing assets – is one of the most effective ways to stop them.”

Publicly addressing counterfeits for the first time in its February 2019 10-K filing, Amazon aptly asserted – in a single line in the “risk factors” section of the yearly report filed with the U.S. Securities and Exchange Commission – that it “may be unable to prevent sellers in our stores or through other stores from selling unlawful, counterfeit, pirated, or stolen goods, selling goods in an unlawful or unethical manner, violating the proprietary rights of others, or otherwise violating our policies.”

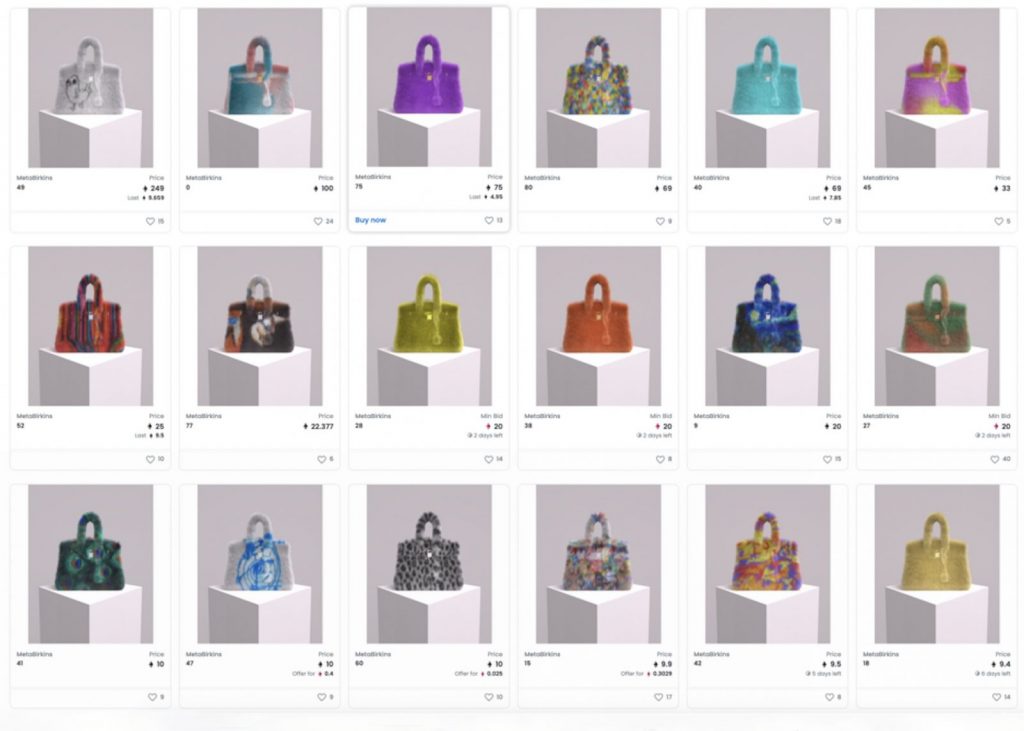

Since then, and despite its attempts to eradicate counterfeits from its marketplace, including via the Project Zero initiative that it introduced in early 2019, Amazon has struggled significantly with a prevalence of fakes on its sweeping marketplace website, which is the foundation of Amazon’s business. The infiltration of the Amazon site with a plethora of fakes – which largely began in 2014 when it enabled China-based entities to sell directly to Amazon shoppers in the West – has prompted scrutiny from the Trump administration, including the U.S. Trade Representative, which included international arms of the American company on its annual blacklist of bad actors this year, as well as from trade organizations and individual brands.

Fight Fakes & Luring Fashion Brands

The seemingly increased push against counterfeits by the Jeff Bezos-founded company – which currently boasts a market capitalization of $1.36 trillion and which generated revenues of $280.5 billion in 2019 – not only comes amid increasing pressure from the U.S. government, it coincides with enduring efforts by Amazon to lure fashion and luxury brands onto its site, something that it has largely struggled to do thus far. Its alliance with Valentino, which is not a seller on its marketplace site, by way of the newly-filed lawsuit seems to suggest that Amazon is serious about building goodwill with luxury brands. Moreover, its recent partnership with Vogue and the Council of Fashion Designers of America – which saw Amazon donate $500,000 to the parties’ “Common Threads” fundraising initiative and offer up a digital storefront for a number of high-end designers – seems to be another sign of Amazon’s efforts to bring fashion brands onto its marketplace.

As for whether it will be able to initiate partnerships with the likes of Bottega Veneta, Valentino, Alexander McQueen, Burberry, Givenchy, and Stella McCartney, among other established names, which is precisely what its Chinese equivalent Alibaba has achieved by way of its Luxury Pavilion, that might be something of a ways off if the tone of LVMH Moët Hennessy Louis Vuitton chairman Bernard Arnault is any indication. In an investor call early this year, Arnault – who maintains the title of the second richest man in the world, following only behind Bezos – did not mince words in saying that while Amazon is “an outstanding company,” where makes money is its vast third-party marketplace of products, in which “they don’t own the stock, [and] they don’t own the inventory.” Instead, Arnault declared, “They use their database to provide customers to other merchants that take a commission, and that … is how they sell counterfeits.”

When specifically asked if his roster of brands, which including Louis Vuitton, Christian Dior, Givenchy, Celine, and Loewe, among others, will be participating in Amazon’s reportedly-impending luxury platform, Arnault said it is “absolutely right” that they will be not be.

Readily accessible fakes are one of the obstacles that Amazon faces in finding friends in the upper echelon of the fashion industry, though. Certainly, such partnerships will not come into fruition (if they do at all) until Amazon can assure brands that their wares will not be sold alongside low-cost fakes. But more than that, Amazon will need to distinctly separate potential luxury offerings from other third-party products on its marketplace, such as groceries and cleaning supplies, both physically, but also in terms of the applicable user interfaces and the larger shopping experience. (This may be part of the impetus for the luxury platform that Amazon has been rumored to be readying).

The retail behemoth will also probably need to hand over an increased amount of control to brands in terms of the merchandising, marketing, and pricing of their products, in something of the same way that department stores like Saks Fifth Avenue have done in terms of their shop-in-shops. After all, these elements often prove to be non-negotiatiables for control-happy luxury brands. And still yet, Amazon just might have to refashion how much information it is able to access and how it will use that information when it comes to luxury brands and their offerings, particularly in light of enduring claims that the company is in the business of utilizing sales and traffic statistics and other seller data to launch, market, and sell competing products. (Amazon has denied such data use).

In short, Amazon likely has quite a few boxes left to check off before winning over the biggest names in fashion, but a robust anti-counterfeiting initiative very well may be an effective step.